The Average Directional Index (ADX) and Directional Movement Indicators (DMI) are essential tools in technical analysis for traders seeking to gauge the strength of a trend and potentially gain an edge in the market. These indicators are part of a group of tools known as oscillators, which help traders assess the momentum and direction of price movements in a security or asset.

The ADX is designed to measure the strength of a trend, regardless of whether it is an uptrend or downtrend. It ranges from 0 to 100, with values above 25 typically indicating a strong trend and values below 20 suggesting a weak or sideways movement.

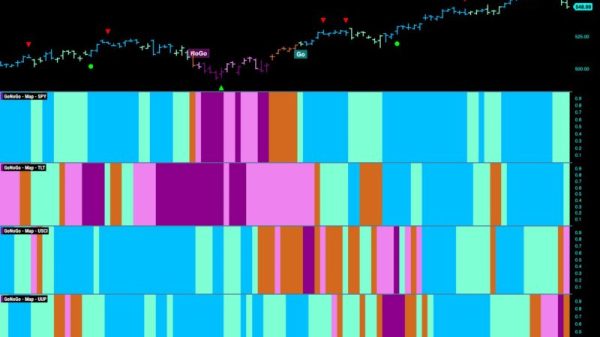

On the other hand, the DMI consists of two lines: the Positive Directional Indicator (+DI) and the Negative Directional Indicator (-DI). +DI measures the strength of upward price movement, while -DI measures the strength of downward price movement. When +DI crosses above -DI, it suggests a potential uptrend, while the opposite scenario indicates a potential downtrend.

By using the ADX in conjunction with the DMI, traders can gain valuable insights into the underlying trend dynamics of a security. For instance, when the ADX is rising along with +DI, it indicates a strong uptrend, while a falling ADX alongside -DI suggests a weakening downtrend.

One key advantage of using the ADX and DMI is their ability to filter out noise and identify significant trends amidst market fluctuations. This can help traders make more informed decisions and improve the accuracy of their trading strategies.

Moreover, these indicators can be used in various trading strategies, such as trend-following or momentum trading. Traders can combine them with other technical analysis tools, such as moving averages or support and resistance levels, to enhance their trading signals and increase the likelihood of successful trades.

It is important for traders to practice using the ADX and DMI in demo accounts or with small positions initially to familiarize themselves with these indicators and gain proficiency in interpreting their signals. Additionally, continuous learning and staying updated on market trends and developments are crucial for traders to effectively leverage these tools and stay ahead in the competitive trading landscape.

In conclusion, the ADX and DMI are powerful tools that can provide traders with valuable insights into market trends and help them make well-informed trading decisions. By understanding how to interpret these indicators and incorporating them into their trading strategies, traders can potentially gain an edge over other market participants and improve their overall trading performance.