In the turbulent waters of investing, where uncertainties and risks abound, the concept of rules-based money management emerges as a beacon of guidance for navigating the complex world of finance. Within this framework lies the critical component of security ranking measures, which help investors make informed decisions in building and managing their portfolios.

Security ranking measures serve as the compass that directs investors toward selecting securities that demonstrate favorable characteristics and align with their investment objectives. By employing a systematic approach to evaluating and ranking securities, investors can enhance their chances of achieving their financial goals while mitigating risks.

One of the key security ranking measures discussed is the Alpha Factor, which provides valuable insights into the risk-adjusted performance of a security. Alpha, often used in conjunction with beta, measures a security’s excess return in comparison to its expected return based on its beta and the overall market performance. A positive alpha indicates that the security has outperformed its expected return, making it an attractive investment option.

Moving beyond the realm of individual securities, investors also utilize security ranking measures to assess the relative strength of sectors and industries within the market. By analyzing the performance of sectors and industries, investors can identify opportunities for sector rotation and capitalize on emerging trends in the market.

Incorporating fundamental analysis into security ranking measures allows investors to delve deeper into the financial health and performance of companies. Fundamental factors such as earnings growth, profitability, and valuation metrics play a crucial role in determining the attractiveness of a security for investment.

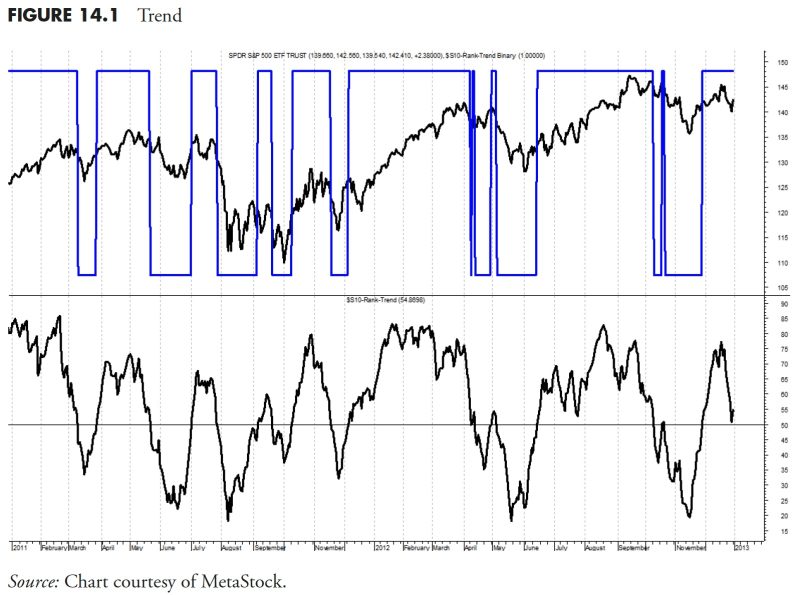

Technical analysis also plays a significant role in security ranking measures, enabling investors to analyze historical price movements and identify patterns that can inform their investment decisions. By utilizing technical indicators and chart patterns, investors can gain valuable insights into the momentum and trends of securities, aiding in their ranking and selection process.

Furthermore, risk management forms an integral part of security ranking measures, ensuring that investors assess and mitigate risks associated with their investment decisions. By incorporating factors such as volatility, correlation, and drawdown analysis, investors can construct portfolios that are well-diversified and optimized for risk-adjusted returns.

In conclusion, security ranking measures form the cornerstone of rules-based money management, providing investors with a systematic approach to evaluating and selecting securities for their portfolios. By leveraging security ranking measures encompassing alpha, sector analysis, fundamental and technical analysis, and risk management, investors can navigate the complexities of the financial markets with confidence and precision, ultimately working toward achieving their investment objectives.