The MACD Pattern: A Trading Game-Changer

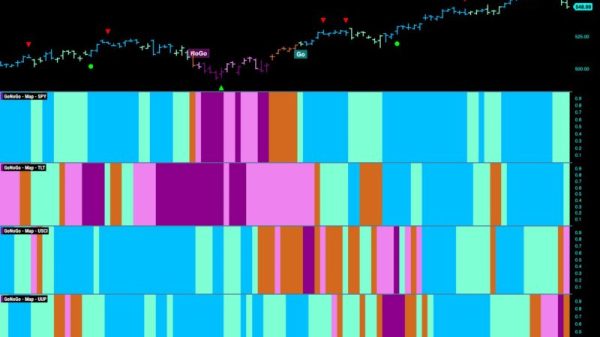

The Moving Average Convergence Divergence (MACD) pattern is a powerful technical analysis tool that has become indispensable for traders in various financial markets. This indicator, developed by Gerald Appel, is used to identify trends, momentum, and potential reversal points in financial instruments such as stocks, currencies, and commodities. The MACD pattern consists of two lines, the MACD line, and the signal line, as well as a histogram that represents the distance between these two lines.

Traders use the MACD pattern in a variety of ways to make informed trading decisions. One of the most common strategies is to look for crossovers between the MACD line and the signal line. When the MACD line crosses above the signal line, it is considered a bullish signal, indicating a potential uptrend. Conversely, when the MACD line crosses below the signal line, it is seen as a bearish signal, suggesting a possible downtrend.

Another popular use of the MACD pattern is to identify divergence between the MACD line and the price of the financial instrument being analyzed. Divergence occurs when the price makes a new high or low, but the MACD does not confirm it. This can signal a potential reversal in the price trend, providing traders with an opportunity to enter or exit a trade.

Moreover, traders also pay attention to the MACD histogram, which represents the difference between the MACD line and the signal line. An increasing histogram indicates that the distance between the two lines is widening, suggesting strengthening momentum in the price movement. Conversely, a decreasing histogram signifies a potential loss of momentum, which could precede a trend reversal.

The versatility of the MACD pattern makes it a valuable tool for traders of all experience levels. Whether used as a standalone indicator or in conjunction with other technical analysis tools, the MACD pattern provides valuable insights into market trends and potential trading opportunities. By mastering the interpretation of this indicator, traders can enhance their trading strategies and make more informed decisions.

In conclusion, the MACD pattern is a game-changer for traders looking to navigate the complexities of financial markets. With its ability to identify trends, momentum, and potential reversals, the MACD pattern empowers traders to stay ahead of the curve and make strategically sound trading decisions. By incorporating this powerful tool into their technical analysis arsenal, traders can gain a competitive edge and achieve greater success in their trading endeavors.