Wyckoff Method in Practice: Intraday Trading Strategies

Understanding the principles of the Wyckoff Method can greatly enhance an intraday trader’s ability to navigate the complex dynamics of the financial markets. Richard Wyckoff’s insightful observations on market psychology, combined with the principles of supply and demand, offer a solid foundation for developing successful trading strategies in shorter timeframes.

Identifying Accumulation and Distribution Phases

Key to the Wyckoff Method is the identification of accumulation and distribution phases within the price action. Intraday traders can leverage these phases to anticipate potential breakouts and breakdowns in the market. Accumulation phases suggest that smart money is accumulating positions at lower prices, preparing for a potential uptrend. On the other hand, distribution phases indicate that institutional investors are offloading their positions, signaling a potential downtrend.

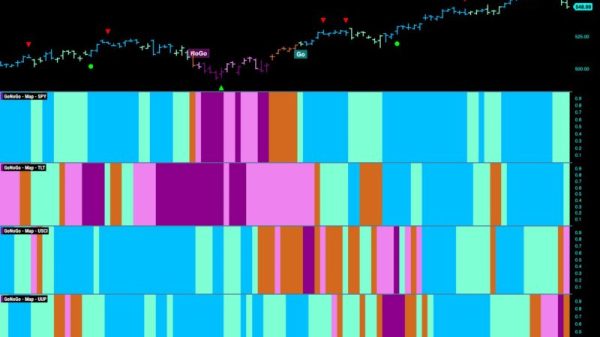

Volume Analysis in Intraday Trading

Volume analysis plays a crucial role in the Wyckoff Method, especially in the intraday timeframe. An increase in volume during a breakout or breakdown suggests strong conviction among market participants, validating the price action. Intraday traders should pay close attention to volume spikes, as they can provide valuable insights into the sustainability of a move.

Techniques for Entry and Exit

Wyckoff’s Method offers several techniques that intraday traders can use for entry and exit points. The ‘Spring’ and ‘Jump across the Creek’ are classic Wyckoff patterns that signify potential reversals and breakouts, respectively. Intraday traders can use these patterns in conjunction with other technical indicators to time their entries and exits effectively.

Risk Management and Trade Psychology

Effective risk management is essential for intraday traders utilizing the Wyckoff Method. By setting appropriate stop-loss levels and position sizes, traders can protect their capital and maximize their returns. Moreover, maintaining a disciplined mindset and adhering to a trading plan is crucial for success in the fast-paced intraday environment.

Implementing Wyckoff Method in Intraday Trading

To effectively implement the Wyckoff Method in intraday trading, traders should focus on developing a deep understanding of market structure and price action. By honing their skills in identifying accumulation and distribution phases, interpreting volume patterns, and applying Wyckoff’s entry and exit techniques, intraday traders can gain a competitive edge in the markets.

Conclusion

In conclusion, the Wyckoff Method offers valuable insights and practical tools for intraday traders seeking to improve their trading performance. By incorporating the principles of supply and demand, volume analysis, and effective risk management strategies, traders can enhance their decision-making process and achieve consistent profitability in the intraday timeframe.