The article titled Gold: Top – Focus On These Potential Price Objectives from GodzillaNewz discusses key potential price objectives to focus on when trading gold. Gold is a timeless asset that has long been considered a safe haven for investors during times of economic volatility. With its intrinsic value and enduring appeal, tracking and understanding gold’s price movements is crucial for anyone looking to profit from this precious metal. In this article, we delve into some important price objectives that traders should keep in mind when analyzing the gold market.

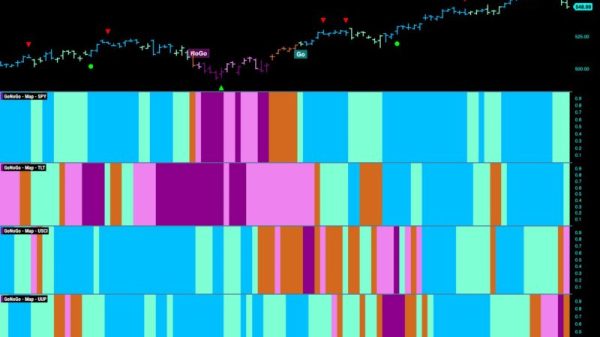

1. **Resistance Levels**: Resistance levels are price points at which the asset historically struggles to rise above. Identifying these levels can help traders anticipate potential price reversals or slowdowns in upward momentum. By focusing on resistance levels, traders can make more informed decisions on when to enter or exit trades.

2. **Support Levels**: On the flip side, support levels represent price points at which an asset historically struggles to fall below. Knowing these levels is crucial for managing risk and setting stop-loss orders to protect against significant losses. By paying attention to support levels, traders can better gauge the downside potential and make decisions accordingly.

3. **Fibonacci Retracement Levels**: Fibonacci retracement levels are widely used by technical analysts to identify potential support and resistance levels based on the Fibonacci sequence. These levels can provide valuable insights into potential price reversals or continuation patterns. By incorporating Fibonacci retracement levels into their analysis, traders can gain a more comprehensive understanding of market dynamics.

4. **Moving Averages**: Moving averages are popular technical indicators that smooth out price data to identify trends over a specified period. By using moving averages, traders can assess the overall direction of the market and spot potential trend reversals. Different moving averages, such as the 50-day and 200-day moving averages, can offer valuable signals for traders.

5. **Trading Volume**: Trading volume refers to the number of shares or contracts traded in a particular asset over a given period. High trading volume can indicate increased market interest and liquidity, while low volume may signal indecision or lack of participation. By observing trading volume alongside price movements, traders can validate the strength of a trend or identify potential reversals.

6. **Market Sentiment**: Market sentiment plays a crucial role in influencing price movements, especially in the gold market. Factors such as geopolitical events, economic data releases, and central bank policies can impact investor sentiment towards gold. By staying attuned to market news and sentiment indicators, traders can better anticipate future price movements and adjust their strategies accordingly.

In conclusion, monitoring key price objectives and factors is essential for traders looking to navigate the gold market successfully. By focusing on resistance and support levels, Fibonacci retracement levels, moving averages, trading volume, and market sentiment, traders can make informed decisions and improve their chances of achieving profitable trades. Keeping a close eye on these critical elements can help traders stay ahead of market trends and capitalize on opportunities in the dynamic gold market.