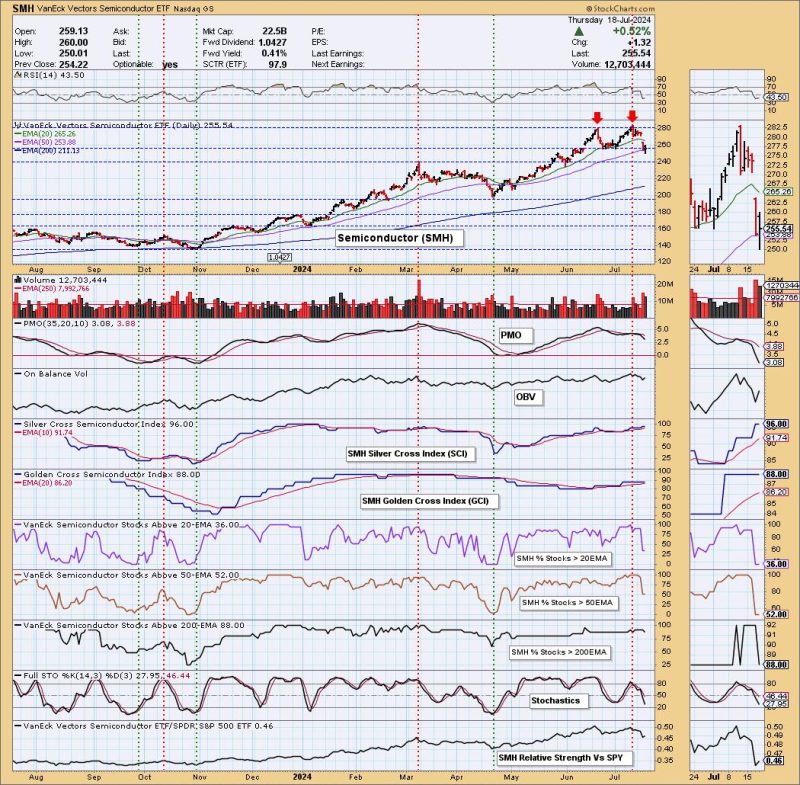

Double Top Pattern on Semiconductors ETF (SMH) – Technical Analysis

The semiconductor industry plays a crucial role in the global economy, powering various technologies we use in our daily lives. The Semiconductor ETF (SMH) is a popular exchange-traded fund that provides exposure to this industry. In the world of technical analysis, patterns often emerge that can provide insights into potential future price movements. One such pattern that has recently appeared on the SMH chart is the Double Top pattern.

A Double Top pattern is a bearish reversal pattern that signals a potential change in trend from bullish to bearish. It is formed when the price reaches a peak, retraces, and then rallies to a similar peak before reversing lower. This pattern is characterized by two distinct peaks at approximately the same price level, with a trough in between.

On the SMH chart, we can clearly see the formation of a Double Top pattern. The price first peaked at a certain level, then retraced slightly before rallying to a similar peak. The trough between the two peaks acts as a support level that, once broken, confirms the pattern. In this case, the support level to watch for a potential confirmation of the pattern lies at the bottom of the trough.

Traders and investors often use the Double Top pattern as a signal to consider taking profits on long positions or even initiate short positions to capitalize on the potential downside move. The height of the pattern can be used to estimate a target for the price decline, which is typically projected below the support level following the confirmation of the pattern.

It is important to note that while the Double Top pattern can be a reliable indicator of a trend reversal, it is not foolproof. Traders should always use other technical analysis tools and risk management strategies to confirm their trading decisions and protect against potential losses.

In conclusion, the appearance of a Double Top pattern on the SMH chart suggests that there may be a bearish reversal on the horizon for the semiconductor sector. Traders and investors should monitor the support level for a potential confirmation of the pattern and consider their trading strategies accordingly. As always, it is essential to conduct thorough analysis and manage risks in any trading or investment decision.