CrowdStrike’s Epic Fail: Here Are the Critical Trading Levels to Watch Now

1. Background of CrowdStrike’s Recent Performance

CrowdStrike Holdings Inc. (NASDAQ: CRWD) is a leading cybersecurity company that provides cloud-based endpoint protection. Despite being a well-known name in the cybersecurity sector, the company recently experienced a significant setback that has impacted its stock performance. CrowdStrike’s stock took a hit after a widely publicized cybersecurity incident involving SolarWinds, leading to a breach that affected multiple companies, including CrowdStrike itself. This incident raised concerns about the security of CrowdStrike’s own systems and highlighted potential vulnerabilities in its cybersecurity measures.

2. Repercussions on CrowdStrike’s Stock Price

The fallout from the SolarWinds incident was reflected in CrowdStrike’s stock price, which experienced a sharp decline in the aftermath of the cybersecurity breach. Investors’ confidence in the company’s ability to protect itself and its clients from such high-profile attacks was shaken, resulting in significant selling pressure on CrowdStrike’s shares. The stock price plummeted from its previous highs, as concerns over the implications of the breach weighed on the company’s valuation.

3. Critical Trading Levels to Monitor

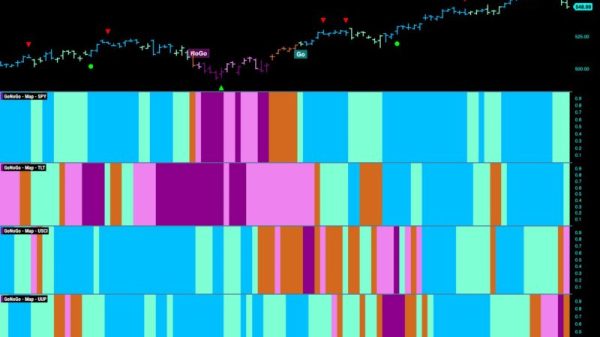

Given the recent challenges faced by CrowdStrike and the uncertainty surrounding its stock price, it is crucial for investors to closely monitor the critical trading levels to assess potential entry and exit points. Here are some key levels to watch:

– Support Levels: The first critical level to watch is the immediate support level, which currently stands at $220. If the stock price breaches this support level, it could signal further downside momentum and potentially trigger additional selling pressure. Monitoring the price action around this support level will provide valuable insights into the stock’s short-term direction.

– Resistance Levels: On the upside, the resistance level to watch is at $250. A breakout above this level could indicate a bullish reversal and potential upside momentum for CrowdStrike’s stock. Traders should pay close attention to the price action near the resistance level to gauge the strength of any potential breakout.

– Moving Averages: Another important indicator to consider is the stock’s moving averages, particularly the 50-day and 200-day moving averages. These moving averages can act as dynamic support and resistance levels, providing valuable insights into the stock’s longer-term trend. Traders should monitor the interaction between the stock price and its moving averages to identify potential buy or sell signals.

4. Risk Management Strategies for Investors

Given the heightened volatility in CrowdStrike’s stock price following the SolarWinds incident, it is essential for investors to implement effective risk management strategies to protect their capital. Here are some key risk management practices to consider:

– Stop-Loss Orders: Setting stop-loss orders at key support levels can help limit potential losses in case the stock price moves against your position. By defining your risk tolerance and implementing stop-loss orders, you can protect your investment from significant downside moves.

– Position Sizing: Proper position sizing is essential when trading volatile stocks like CrowdStrike. By allocating a small percentage of your portfolio to each trade, you can mitigate the impact of potential losses and diversify your risk exposure across multiple positions.

– Patience and Discipline: Maintaining a disciplined approach to trading and exercising patience in volatile market conditions can help you avoid impulsive decisions driven by emotions. By sticking to your trading plan and strategy, you can make informed decisions based on objective analysis rather than reacting to short-term price fluctuations.

In conclusion, CrowdStrike’s recent cybersecurity incident has had a significant impact on its stock price, leading to increased volatility and uncertainty among investors. By closely monitoring the critical trading levels and implementing effective risk management strategies, investors can navigate the current challenges and position themselves for potential opportunities in CrowdStrike’s stock.