The Federal Reserve: A Self-Created Nightmare

The Federal Reserve, often referred to simply as “the Fed,” is the United States’ central banking system, responsible for making decisions that have far-reaching implications on the country’s economic stability and growth. However, recent developments have raised questions about the Fed’s actions and their potential impacts on the economy.

One of the primary concerns is the Fed’s aggressive monetary policy in response to the economic challenges posed by the COVID-19 pandemic. In an effort to stimulate the economy, the Fed has engaged in massive asset purchases and implemented near-zero interest rates. While these measures were intended to provide support during a time of crisis, they have also had unintended consequences.

By flooding the financial markets with liquidity, the Fed has created an environment of artificially low interest rates that can distort market signals and incentivize risky behavior. This has led to concerns about asset bubbles forming in various sectors of the economy, including the stock market and real estate.

Moreover, the Fed’s actions have sparked fears of inflation, as the increased money supply could potentially lead to rising prices. This could erode the purchasing power of consumers and undermine the stability of the economy in the long run.

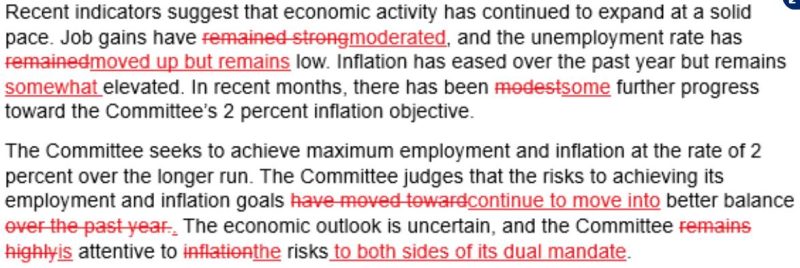

Another issue at play is the Fed’s communication strategy, which has sometimes been inconsistent and confusing. Markets rely on clear and transparent guidance from the Fed to make informed decisions, and mixed messages can introduce uncertainty and volatility.

Furthermore, critics argue that the Fed’s intervention in the economy has distorted market mechanisms and undermined the principles of free market capitalism. By propping up certain sectors and companies through monetary stimulus, the Fed may be perpetuating inefficiencies and inhibiting necessary market corrections.

As the Fed continues to grapple with the challenges of promoting economic growth while maintaining stability, it must carefully consider the long-term consequences of its policies. Balancing the need for short-term support with the risks of creating unsustainable conditions will be crucial in navigating the complex economic landscape ahead.

In conclusion, the Federal Reserve’s well-intentioned efforts to support the economy during the COVID-19 pandemic have inadvertently created a situation fraught with potential risks. As the Fed moves forward, it must tread carefully to avoid exacerbating these issues and work towards a more sustainable and resilient financial system that benefits all Americans.