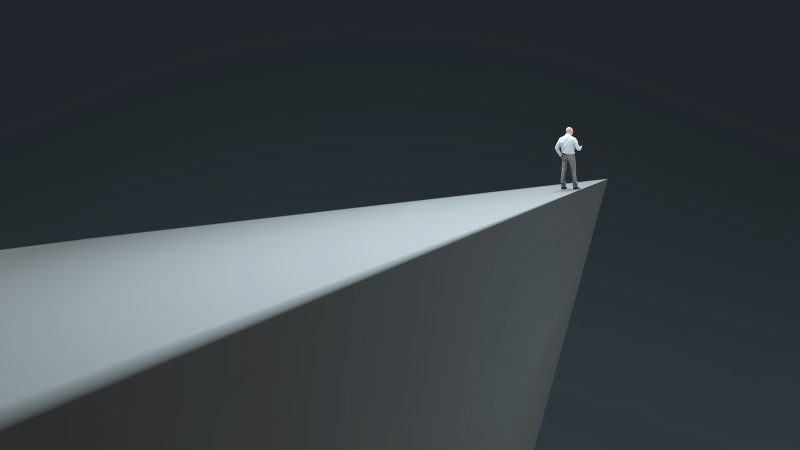

In recent days, the Nasdaq has been teetering on the edge as investors closely monitor critical levels that could potentially either stabilize or further jeopardize the market. The tech-heavy index has faced significant volatility, with various factors contributing to the uncertain landscape. Here, we delve into some of the key levels that investors must watch closely as the Nasdaq navigates through this challenging period.

1. **Support Levels**: One of the crucial aspects that investors are closely monitoring is the support levels for the Nasdaq. Support levels represent a price point at which a security experiences a pause or reversal in its current downtrend. For the Nasdaq, key support levels serve as a foundation for the index, indicating areas where investors may step in to buy, thereby preventing further downside momentum. Should the Nasdaq breach these support levels, it could signal a deeper correction in the market.

2. **Resistance Levels**: On the flip side, resistance levels are equally important to consider during this period of uncertainty. Resistance levels indicate a price point at which a security struggles to break through, often leading to a pullback or stagnation in the market. Investors are closely monitoring these levels as potential barriers that could determine the Nasdaq’s ability to push higher or face further selling pressure.

3. **Volatility Indicators**: Volatility indicators, such as the VIX (CBOE Volatility Index), play a significant role in determining market sentiment and potential price movements. An increase in volatility often signifies heightened market uncertainty and can lead to sharp fluctuations in asset prices. Investors are keeping a close eye on volatility indicators to gauge the overall risk appetite in the market and anticipate potential shifts in market direction.

4. **Moving Averages**: Moving averages are essential technical indicators used by investors to identify trends and potential areas of support or resistance. The 50-day and 200-day moving averages are especially critical for traders as they signal short-term and long-term trends in the market. Investors are closely monitoring these moving averages to assess the overall health of the Nasdaq and make informed decisions based on technical analysis.

5. **Market Sentiment**: Market sentiment plays a crucial role in determining the direction of asset prices. Investor sentiment can often drive market movements, leading to either bullish or bearish behavior. During this period of uncertainty, investors are paying close attention to market sentiment indicators to gauge the overall mood of market participants and anticipate potential shifts in market dynamics.

In conclusion, as the Nasdaq teeters on the edge amidst heightened volatility and uncertainty, investors must closely monitor critical levels to navigate through this challenging period. By keeping a watchful eye on support and resistance levels, volatility indicators, moving averages, and market sentiment, investors can make well-informed decisions and adapt to the evolving market conditions. It is imperative for investors to remain vigilant, exercise caution, and stay informed to effectively navigate the current market landscape.