The week ahead is shaping up to be a critical one for the Nifty as defensive setups develop and key levels come into focus. Market participants are closely watching how the index reacts to these levels and whether it can maintain its tentative stance in the face of growing uncertainty. Let’s delve into the technical analysis and key areas of interest for traders and investors in the coming week.

Starting with the broader market outlook, the Nifty has been exhibiting a cautious stance, with a defensive setup taking shape. This is reflected in the recent trading patterns and the behavior of key indicators. The index has been hovering around crucial support and resistance levels, indicating a tug of war between bulls and bears.

One key level to watch in the upcoming week is the 15,800 mark. This level has been acting as a significant resistance, capping the upside momentum for the Nifty. A decisive breakout above this level could signal renewed bullish strength and pave the way for further upside potential. On the other hand, a failure to breach this level could keep the index range-bound or even lead to a pullback towards lower support levels.

On the downside, the 15,400 level stands out as a critical support zone. The Nifty has been finding buying interest around this level, preventing any sharp declines in the index. A breach below this level could open the door for further downside towards the next support at 15,200. Traders will be closely monitoring how the index reacts around these support levels and whether it can hold ground in the face of selling pressure.

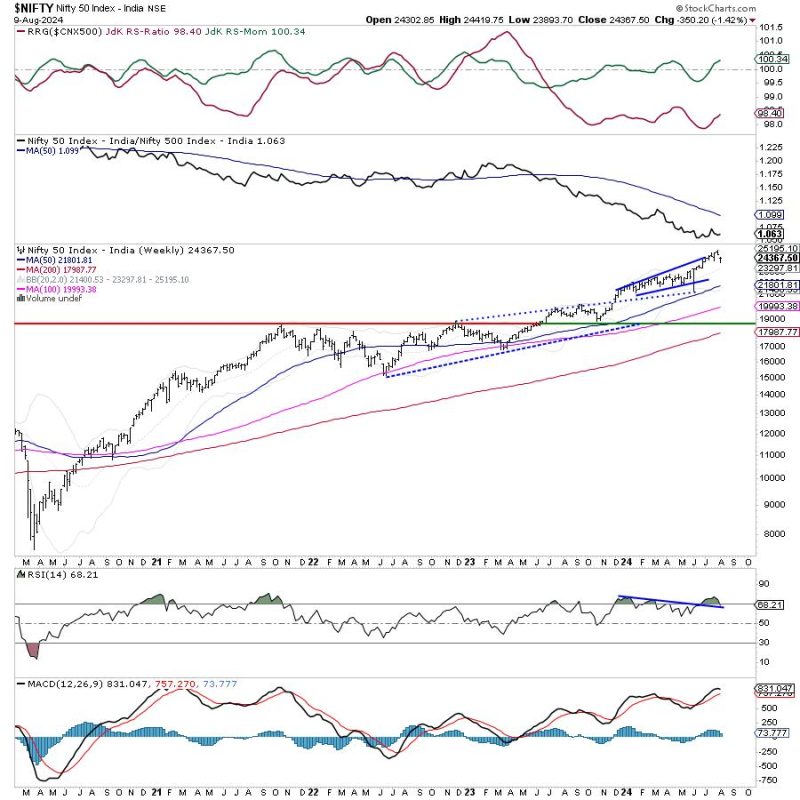

In terms of technical indicators, the Relative Strength Index (RSI) and Moving Averages are providing valuable insights into the market sentiment. The RSI has been hovering around the neutral zone, reflecting the indecisiveness in the market. A move towards the overbought or oversold territory could provide clues about the future direction of the Nifty.

Similarly, the Moving Averages, such as the 50-day and 200-day MA, are acting as dynamic support and resistance levels, guiding traders in their decision-making process. The interplay between these moving averages and the price action of the Nifty will be crucial in determining the short to medium-term trend.

Overall, the Nifty remains in a tentative phase as defensive setups develop and key levels come into focus. Traders and investors need to stay nimble and adapt to changing market conditions to navigate through the uncertainty. By keeping a close eye on the technical indicators and key support/resistance levels, market participants can position themselves strategically in the week ahead.