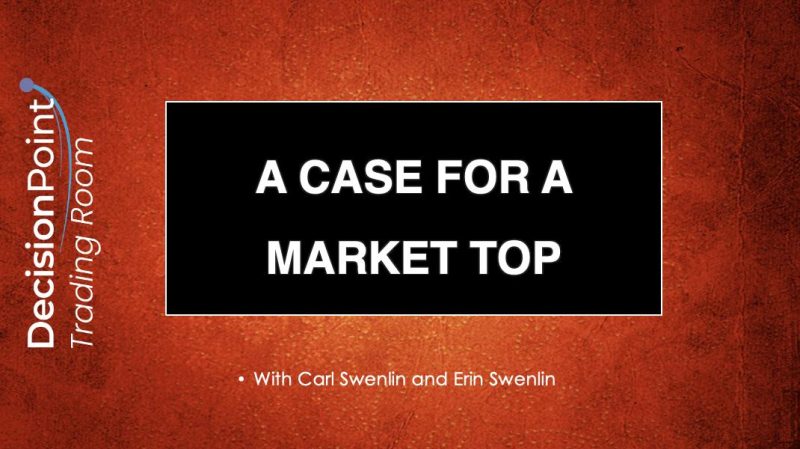

Deconstructing the arguments put forth in the article DP Trading Room: A Case for a Market Top from GodzillaNewz.com, reveals a variety of perspectives and insights that may provide valuable context for investors and traders assessing market conditions. The article suggests that the DP Trading Room approach, which uses various technical indicators and market analysis tools, is pointing towards a potential market top. While the article presents a compelling case, it is important to consider various other factors that can impact market movements.

One of the key points discussed by the article is the use of technical indicators such as moving averages and trend analysis to predict potential market reversals. These indicators can certainly provide valuable signals about the current trend and momentum of the market. However, it is crucial to recognize that technical indicators are not foolproof and should be used in conjunction with other forms of analysis.

In addition to technical indicators, the article also references the importance of investor sentiment and market psychology in predicting market tops. Market sentiment can be a powerful driver of short-term market movements, as fear and greed can lead to abrupt changes in market direction. By monitoring sentiment indicators and survey data, investors can gain valuable insights into the prevailing mood of the market.

Moreover, the article raises the significance of macroeconomic factors in determining market tops. Economic indicators such as GDP growth, inflation rates, and interest rates can have a substantial impact on investor confidence and market valuations. By staying informed about key economic data releases and central bank policy decisions, traders can better position themselves to navigate potential market tops.

It is essential for investors to adopt a holistic approach to analyzing market conditions, combining technical analysis, sentiment indicators, and macroeconomic factors to form a comprehensive view of the market environment. While the DP Trading Room methodology provides a structured framework for market analysis, it is important to supplement this approach with a broad range of sources and perspectives.

In conclusion, the article DP Trading Room: A Case for a Market Top offers valuable insights into the potential signs of market exhaustion and reversal. By integrating technical analysis, sentiment indicators, and macroeconomic factors, investors can gain a deeper understanding of market dynamics and make more informed trading decisions. However, it is crucial to remain vigilant and adapt to changing market conditions, as no single approach can guarantee success in the dynamic world of trading and investing.