In a week anticipated to be dense with impactful news and events, the financial markets are showing signs of caution, hinting at a short-term bearish sentiment. As investors gear up for crucial announcements and data releases, market participants are bracing themselves for potential turbulence in the near future. The confluence of various factors in the economic landscape sets the stage for a volatile trading environment as traders adjust their strategies to navigate the uncertainties ahead.

One significant element contributing to the cautious outlook is the upcoming Federal Reserve meeting, where policymakers are expected to communicate their stance on monetary policy. The Fed’s decisions and statements play a pivotal role in shaping market sentiment, influencing investor behavior and market dynamics. Any hints of a shift in the Fed’s approach to interest rates or asset purchases could trigger sharp movements in stock prices and bond yields.

Adding to the mix of potential market-moving events are key economic indicators scheduled for release throughout the week. Reports on inflation, retail sales, and jobless claims will provide critical insights into the state of the economy and the trajectory of recovery from the pandemic-induced downturn. Market participants will closely scrutinize these data points for clues on the strength of consumer spending, inflationary pressures, and the labor market, all of which have direct implications for asset valuations and investor sentiment.

Geopolitical developments further complicate the market outlook, with uncertainties surrounding trade tensions, political dynamics, and global events looming large. From ongoing trade negotiations to geopolitical conflicts and natural disasters, external factors can disrupt markets and amplify volatility, prompting investors to reassess risk exposures and adjust their portfolios accordingly.

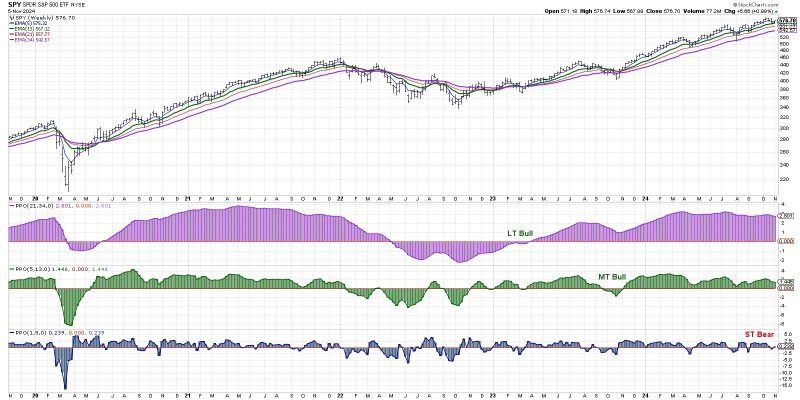

Technically, market indicators and chart patterns are flashing signals that suggest a short-term bearish bias. A divergence between price action and key technical indicators, combined with weakening market breadth and elevated levels of investor complacency, point to a potential correction or pullback in the near future. As traders monitor these technical signals alongside fundamental developments, they may adopt defensive strategies to protect capital and capitalize on downside opportunities.

In conclusion, the financial markets are bracing for a news-heavy week fraught with uncertainties and potential market-moving events. As investors navigate through a landscape of economic data releases, central bank decisions, and geopolitical risks, the cautious sentiment prevailing in the markets reflects a readiness for potential downside risks. By staying informed, remaining agile, and adapting to changing market conditions, investors can position themselves to navigate the short-term challenges and find opportunities amid the turbulence.