Sentiment and Small Caps: A Winning Combination

In the world of investing, staying ahead of market trends and patterns is essential for success. For many investors, the combination of sentiment analysis and small-cap stocks has proven to be a formidable strategy, effectively knocking out the staggering bears and creating opportunities for substantial returns.

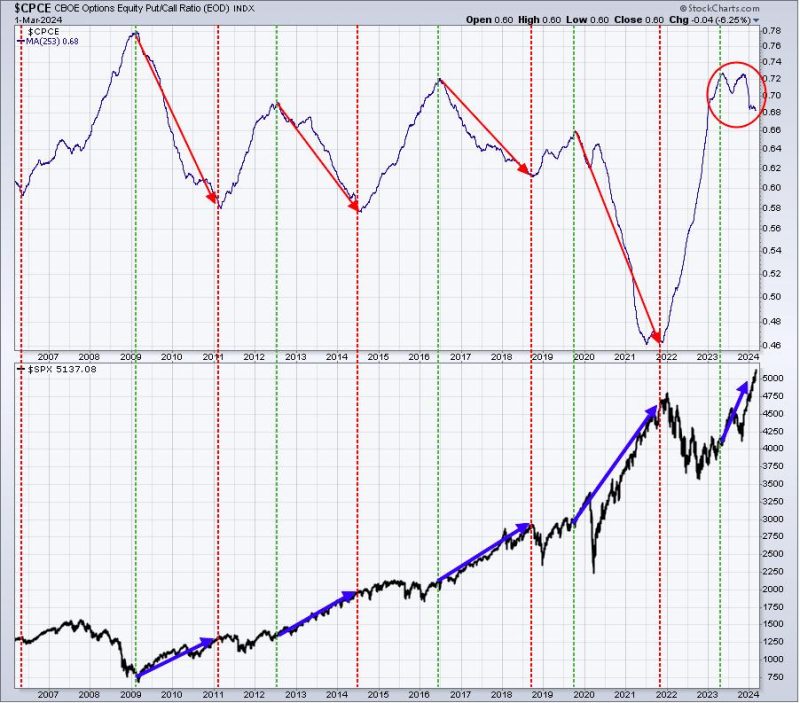

Sentiment analysis involves analyzing emotions, attitudes, and opinions expressed by individuals or groups towards a specific market or asset. By tapping into sentiment data, investors can gauge market sentiment and identify potential trends before they fully materialize. This proactive approach provides investors with a competitive edge, allowing them to make informed decisions based on the prevailing market sentiment.

Small-cap stocks, on the other hand, refer to companies with a relatively small market capitalization. While small-cap stocks are often perceived as riskier investments due to their size and volatility, they also offer significant growth potential. These companies are typically more agile and responsive to changing market conditions, making them attractive options for investors seeking high-growth opportunities.

When sentiment analysis is applied to small-cap stocks, a powerful synergy is created. By monitoring sentiment towards specific small-cap companies, investors can uncover hidden gems and identify promising investment opportunities before they gain mainstream attention. This early detection of positive sentiment can lead to significant gains as small-cap stocks begin to outperform the market and attract more investors.

One of the key advantages of combining sentiment analysis with small-cap stocks is the ability to capitalize on market inefficiencies. Small-cap stocks are often less covered by analysts and institutional investors, creating opportunities for individual investors to discover undervalued companies with strong growth potential. By leveraging sentiment analysis to identify positive market sentiment towards these under-the-radar stocks, investors can position themselves for outsized returns as these companies attract more attention and see their stock prices rise.

Moreover, sentiment analysis can help investors navigate the ups and downs of the market by providing insights into market sentiment shifts and potential turning points. By monitoring sentiment indicators, investors can adjust their investment strategies accordingly and stay ahead of market trends. This proactive approach can help investors avoid major losses during market downturns and capitalize on opportunities for profits during market upswings.

In conclusion, the combination of sentiment analysis and small-cap stocks presents a winning formula for investors looking to outperform the market and achieve significant returns. By leveraging sentiment data to identify positive market sentiment towards small-cap companies, investors can uncover hidden opportunities, capitalize on market inefficiencies, and stay ahead of market trends. With the right strategy and a keen eye for sentiment analysis, investors can effectively knockout the staggering bears and position themselves for success in the dynamic world of investing.