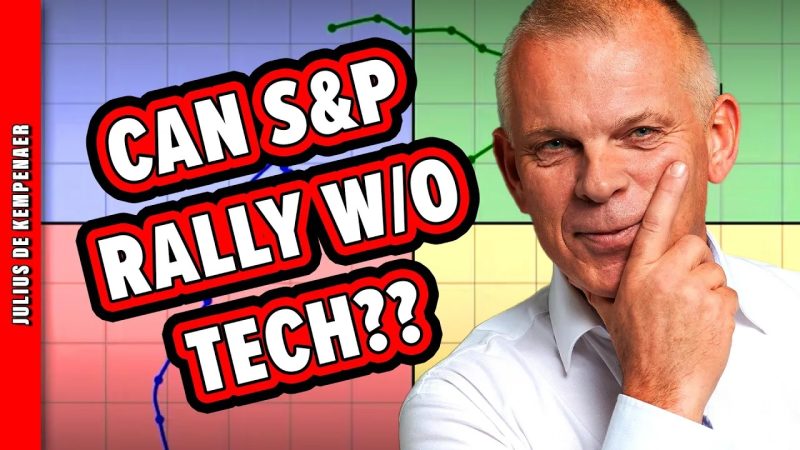

The S&P 500, one of the most widely followed indices in the world, is composed of a diverse array of companies across various sectors. While tech stocks have historically played a significant role in driving the performance of the index, the question of whether the S&P 500 can rally without a strong tech sector presence is an intriguing one.

One key factor to consider is the concept of sector rotation. This phenomenon occurs when investors shift their focus from one sector to another based on changing economic conditions or market trends. In the absence of strong performance from the tech sector, other sectors such as consumer discretionary, healthcare, or industrials may emerge as leaders and drive the overall performance of the S&P 500.

Furthermore, the composition of the S&P 500 is not static and is periodically rebalanced to ensure representation of the most prominent companies in the market. This means that even if the tech sector were to underperform, the inclusion of companies from other sectors that are performing well could potentially compensate for any weakness in tech stocks.

Additionally, market sentiment and investor psychology play a crucial role in determining the direction of the S&P 500. While tech stocks have been favored by investors for their growth potential and innovation, shifts in sentiment could lead to a broader reevaluation of investment opportunities across different sectors. If investors perceive value in sectors outside of tech, they may redirect their capital accordingly, supporting a rally in the S&P 500 even in the absence of a tech-driven surge.

It is also worth considering the global economic environment and geopolitical factors, which can influence the performance of the S&P 500 independent of the tech sector. Factors such as interest rates, trade policies, and geopolitical tensions can have a significant impact on market performance, and investors need to take a holistic view of the markets to assess the potential for a sustained rally in the index.

In conclusion, while the tech sector has been a key driver of the S&P 500’s performance in recent years, the index has the resilience and diversity to rally even in the absence of a strong tech sector presence. Sector rotation, changes in market composition, investor sentiment, and external economic factors all play a role in shaping the performance of the index. By monitoring these various factors and maintaining a diversified investment approach, investors can navigate market fluctuations and potentially benefit from rallies in the S&P 500 regardless of the performance of the tech sector.