Body:

1. The Current State of Buy Signals: A Diminishing Trend

In the world of investing, buy signals play a vital role in determining optimal entry points for traders and investors. These signals act as a guide, providing insights into market trends and indicating when it may be advantageous to buy a particular asset. However, in recent times, buy signals have been fading, losing their efficacy and leaving market participants with decreased clarity on investment decisions.

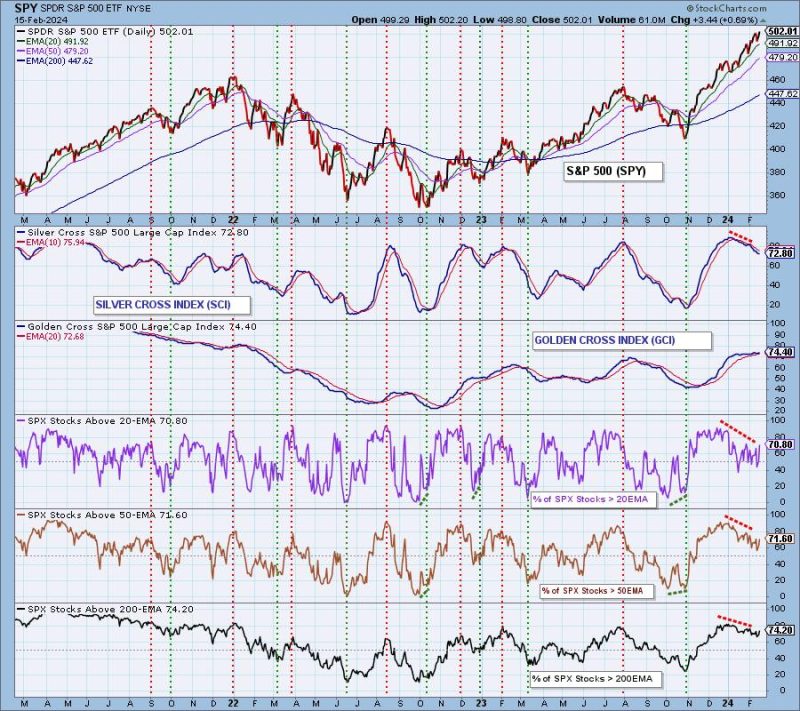

2. Market Indicators and Historical Importance

Market indicators, such as moving averages, oscillators, and technical analysis patterns, have long been relied upon to generate buy signals. These indicators look for patterns, trends, and market behaviors that historically have resulted in profitable trading opportunities. By identifying these patterns, investors can make informed decisions and increase their chances of success.

3. The Ineffectiveness of Traditional Buy Signals

Despite their historical importance, traditional buy signals have been showing signs of diminished effectiveness. The rapid advancement of technology, alongside changing market dynamics, has introduced complexities that make it harder for traditional indicators to accurately predict market movements.

4. The Influence of Algorithmic Trading

Algorithmic trading, popularly known as algo-trading, has become increasingly prevalent in today’s financial markets. This computerized trading system relies on complex algorithms to execute trades, removing human bias and emotions from the decision-making process. With high-frequency trading and machine learning capabilities, algo-trading can quickly process vast amounts of data and make lightning-fast trades based on sophisticated algorithms.

However, the rise of algorithmic trading has disrupted the effectiveness of traditional buy signals. These systems can react almost instantaneously to market movements, rendering traditional indicators less reliable. By the time a traditional indicator generates a buy signal, the market may have already changed direction, causing traders to potentially miss out on lucrative opportunities.

5. The Impact of Market Manipulation

In addition to the rise of algo-trading, market manipulation has become a growing concern in recent years. Unscrupulous traders use various tactics, such as pump-and-dump schemes or spreading false information on social media, to create artificial demand and inflate prices. This manipulation can result in false buy signals, leading unknowing investors down a risky path.

6. Shifting Market Dynamics and Fundamental Analysis

As market dynamics change, traditional buy signals are also losing their relevance. In today’s interconnected and globalized world, markets are influenced by an array of factors beyond technical indicators. Fundamentals, such as economic data, geopolitical events, and company-specific news, play a crucial role in market movements.

Traders and investors have started to incorporate fundamental analysis into their decision-making process, giving more weight to news and events that impact an asset’s value. This shift further diminishes the significance of traditional buy signals, as they fail to capture the broader market sentiment and fundamental factors that drive prices.

7. The Rise of Alternative Approaches

Given the diminishing effectiveness of traditional buy signals, investors are exploring alternative approaches to make informed investment decisions. One such approach is quantitative analysis, which involves the use of complex mathematical models and statistical techniques to identify trading opportunities. By analyzing vast datasets and identifying patterns, quantitative analysis aims to produce more reliable insights into market behavior.

Furthermore, investors are increasingly turning to sentiment analysis and data-driven algorithms in conjunction with technical indicators to generate more accurate buy signals. By monitoring social media sentiment and news sentiment, these approaches aim to capture the broader market sentiment and incorporate it into the decision-making process.

Conclusion:

As technology advances and market dynamics evolve, traditional buy signals are losing their effectiveness. The rise of algorithmic trading, market manipulation, shifting dynamics, and the incorporation of fundamental analysis are all contributing to the decreasing relevance of traditional indicators. Investors must adapt and explore alternative approaches to make informed investment decisions in this ever-changing landscape. By incorporating quantitative analysis, sentiment analysis, and other data-driven approaches, traders and investors can better navigate the dynamic markets of today.