Using the ATR Trailing Stop to Manage the Trade and Define the Trend

The Average True Range (ATR) is a popular technical indicator that measures market volatility. In conjunction with the trailing stop feature, the ATR can be a powerful tool for traders to manage their trades and define trends effectively.

Setting a trailing stop based on the ATR allows traders to lock in profits and protect against significant losses. By adjusting the stop level based on market volatility, traders can adapt to changing market conditions and avoid being stopped out prematurely in a volatile market.

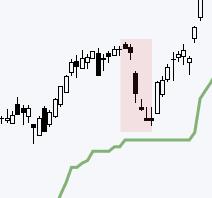

The ATR trailing stop can also help traders identify the trend direction. When the price is trending strongly, the distance between the price and the trailing stop will be wider, indicating a strong trend. Conversely, during periods of consolidation or choppy price action, the trailing stop will be closer to the price, reflecting a lack of clear trend.

Implementing the ATR trailing stop strategy involves calculating the ATR value, which is typically based on a 14-period moving average of price ranges. Traders can then determine a multiple of the ATR to use as the trailing stop distance. A common approach is to use 1.5 to 3 times the ATR value as the trailing stop distance.

By using the ATR trailing stop to manage trades, traders can minimize emotional decision-making and rely on a systematic approach to trade management. This helps traders stay disciplined and stick to their trading plan, regardless of market fluctuations.

In conclusion, the ATR trailing stop is a valuable tool for traders to manage trades, lock in profits, and define trends in the market. By incorporating this indicator into their trading strategy, traders can enhance their risk management practices and improve their overall trading performance.