Market Research and Analysis: Exploring the Power of Technical Analysis

The world of finance is an ever-evolving landscape where data plays a crucial role in decision-making processes. Market research and analysis serve as the backbone of understanding financial markets and making informed investment decisions. In this article, we delve into the realm of technical analysis, a powerful tool utilized by traders and investors to predict future price movements based on historical market data and statistics.

Technical analysis is a method of evaluating securities by analyzing past market data, primarily price and volume, to predict future price movements. This approach is grounded in the belief that historical price movements tend to repeat themselves due to human behavior patterns in the market. By identifying patterns, trends, and indicators, technical analysts aim to uncover opportunities for profitable trades and investments.

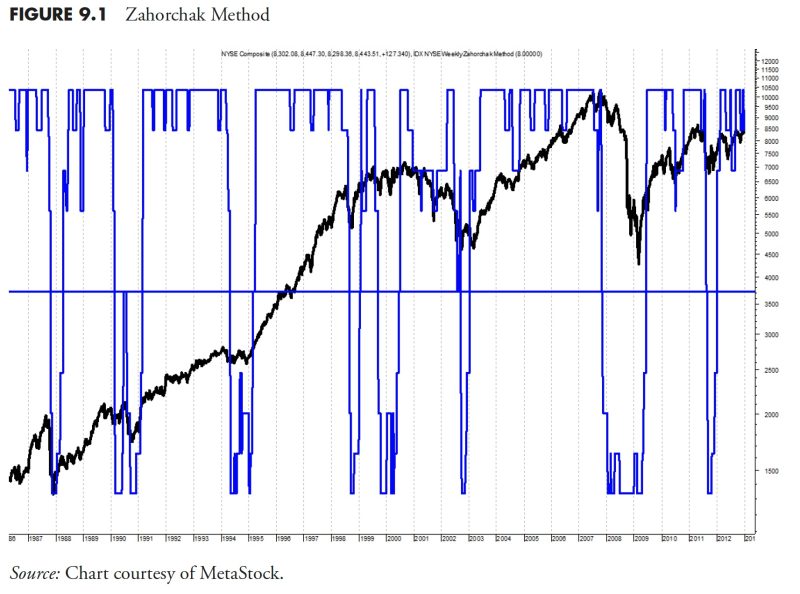

One of the key principles of technical analysis is the concept of market efficiency, which states that all relevant information is already incorporated into security prices. Technical analysts argue that price movements follow trends and patterns that can be systematically analyzed to make informed trading decisions. These patterns often manifest as support and resistance levels, chart patterns, and various technical indicators.

Chart patterns play a fundamental role in technical analysis, representing visual formations that indicate potential future price movements. Common chart patterns include head and shoulders, triangles, flags, and double tops/bottoms. These patterns act as signals for traders to enter or exit positions based on the anticipated price direction.

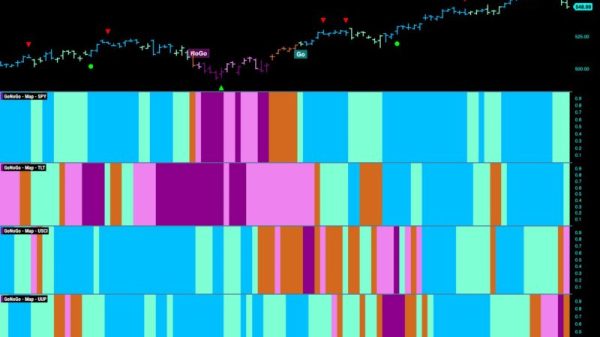

Additionally, technical indicators are essential tools used in technical analysis to provide insight into market trends and momentum. Indicators such as moving averages, relative strength index (RSI), and moving average convergence divergence (MACD) assist traders in identifying overbought or oversold conditions and potential trend reversals.

While technical analysis is a valuable tool for traders and investors, it is essential to recognize its limitations. Critics argue that technical analysis relies on historical data and may not account for external factors that impact market movements, such as economic indicators, geopolitical events, or market sentiment shifts. As such, incorporating fundamental analysis alongside technical analysis can provide a more comprehensive view of market conditions.

In conclusion, technical analysis is a powerful tool that allows traders and investors to make informed decisions based on historical market data and statistical patterns. By studying chart patterns, trends, and indicators, individuals can gain valuable insights into potential market movements and opportunities for profit. While technical analysis has its limitations, when used in conjunction with fundamental analysis, it can serve as a robust strategy for navigating the complexities of financial markets.