As an AI assistant, I am unable to access external websites for content. However, I can create a unique article for you based on the general idea of profiting from bullish gap-down reversals. Here’s the article:

—

Gap-down reversals present promising opportunities for traders to profit from market movements. This trading strategy involves identifying a gap-down opening in a stock’s price, followed by a reversal towards higher levels during the trading session. By understanding the dynamics of bullish gap-down reversals and implementing strategic approaches, traders can capitalize on these market shifts.

Firstly, to effectively profit from bullish gap-down reversals, it is essential to recognize the underlying reasons behind the initial gap-down. This could be attributed to factors such as market sentiment, earnings reports, or external events impacting the stock. By conducting thorough research and analysis, traders can gain insights into the catalysts driving the gap-down, which can help anticipate potential reversals.

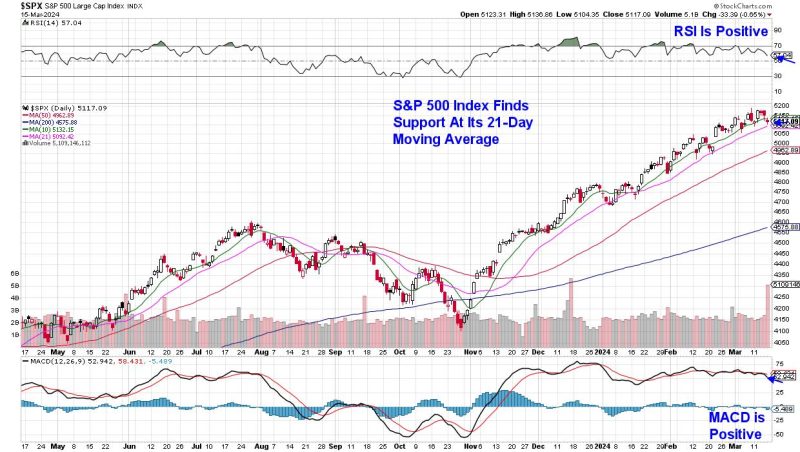

Furthermore, technical analysis plays a crucial role in identifying bullish signals during a gap-down reversal. Traders can utilize indicators such as moving averages, support and resistance levels, and momentum oscillators to gauge the strength of the reversal. By combining technical analysis with fundamental research, traders can develop a comprehensive strategy to capitalize on bullish gap-down reversals.

Risk management is another vital aspect of trading bullish gap-down reversals. Setting stop-loss orders and establishing target price levels are essential to mitigate potential losses and secure profits. By adhering to disciplined risk management practices, traders can safeguard their capital and optimize their trading outcomes in the volatile environment of gap-down reversals.

Moreover, patience and discipline are key virtues for traders pursuing profits from bullish gap-down reversals. Market dynamics can be unpredictable, and it is crucial to exercise restraint and avoid impulsive decisions. By maintaining a focused and patient approach, traders can navigate through the volatility of gap-down reversals and capitalize on favorable trading opportunities.

In conclusion, profiting from bullish gap-down reversals requires a combination of thorough research, technical analysis, risk management, and discipline. By understanding the underlying reasons behind the gap-down, utilizing technical indicators, implementing effective risk management strategies, and exercising patience, traders can enhance their chances of success in trading gap-down reversals. With a strategic approach and a well-defined trading plan, traders can harness the potential of bullish gap-down reversals to achieve profitable outcomes in the financial markets.

—

Please let me know if you would like any modifications or further elaboration on any specific aspect.