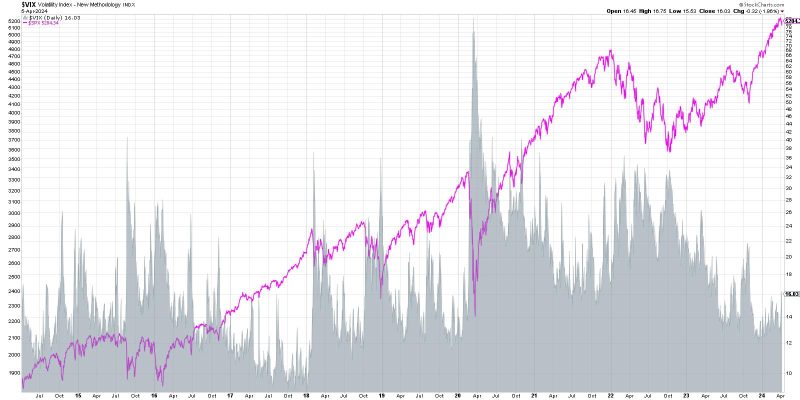

The recent spike in the VIX index above 16 has brought fears of a potential market downturn and raised concerns among investors. The VIX, also known as the fear gauge, measures market volatility and investor sentiment. When the VIX spikes, it typically indicates increased perceived risk and uncertainty in the market.

Market analysts closely monitor the VIX as it provides insights into market expectations for future volatility. A spike in the VIX often coincides with a decrease in stock prices, as investors become more cautious and risk-averse. The recent spike above 16 has triggered debates among investors and analysts about the potential implications for the stock market.

Some analysts believe that the spike in the VIX could be a precursor to a market correction or even a bear market. They argue that heightened volatility usually signals underlying instability in the market and could lead to a broad-based selloff. Investors are advised to tread carefully and consider adjusting their portfolios to manage potential risks during such periods of increased volatility.

On the other hand, some analysts view the spike in the VIX as a temporary anomaly, driven by specific events or external factors. They suggest that investors should not overreact to short-term fluctuations in the VIX and instead focus on the long-term fundamentals of their investments. In times of increased volatility, maintaining a diversified portfolio and staying disciplined with investment strategies can help investors navigate market uncertainties.

It is essential for investors to stay informed about market trends and events that could impact the VIX and overall market sentiment. Geopolitical tensions, economic data releases, and corporate earnings reports are among the factors that could influence market volatility and trigger changes in the VIX index. By staying vigilant and monitoring market developments, investors can make informed decisions to protect their investments and potentially capitalize on market opportunities.

In conclusion, while a spike in the VIX above 16 may raise concerns among investors, it is crucial to approach market volatility with a level-headed strategy. Understanding the dynamics of the VIX index and its implications for market sentiment can help investors navigate uncertain market conditions and make informed investment decisions. By staying focused on long-term goals and maintaining a disciplined investment approach, investors can weather market fluctuations and strive for financial success.