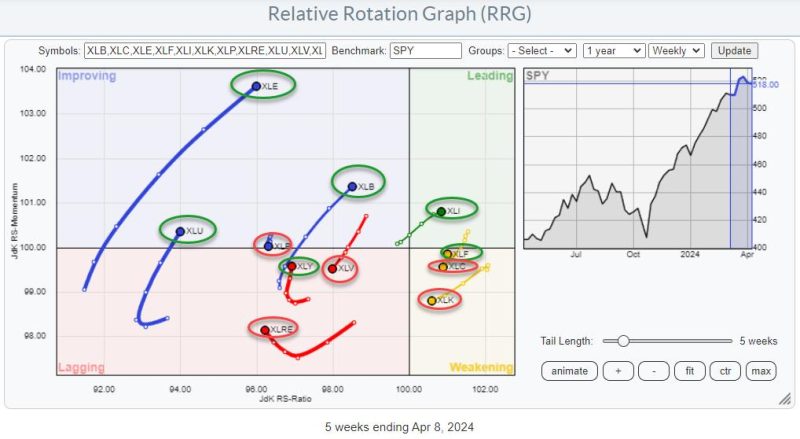

The article discusses how the RRG (Relative Rotation Graph) analysis indicates positive developments for non-mega-cap technology stocks. The RRG is a tool used in technical analysis to visualize the relative strength of investments compared to a benchmark. In the context of non-mega-cap technology stocks, this tool is particularly insightful in identifying trends and opportunities within the sector.

The RRG analysis reflects the movement of various stocks relative to a benchmark index, helping investors to make informed decisions about their portfolios. In the current market environment, where technology continues to play a crucial role in driving innovation and growth, understanding the relative strength of non-mega-cap stocks is essential.

One of the key observations from the RRG analysis is the improving trajectory of non-mega-cap technology stocks. This indicates a shift in investor sentiment towards these stocks, potentially offering attractive investment opportunities. As the technology sector undergoes rapid evolution and disruption, non-mega-cap stocks represent companies with growth potential and agility to adapt to changing market dynamics.

Investors can leverage the insights provided by the RRG analysis to identify promising non-mega-cap technology stocks that are on an upward trajectory. By diversifying their portfolios with these stocks, investors can benefit from the growth potential of innovative companies operating in dynamic sectors such as cloud computing, artificial intelligence, and e-commerce.

Furthermore, the RRG analysis highlights the importance of monitoring relative performance and rotation of stocks within the technology sector. By staying abreast of these dynamics, investors can capitalize on emerging trends and position their portfolios for long-term success. The relative strength of non-mega-cap technology stocks can provide valuable signals about market sentiment and investor preferences, guiding investment decisions in a competitive and rapidly changing landscape.

In conclusion, the RRG analysis serves as a valuable tool for investors seeking to capitalize on the improving prospects of non-mega-cap technology stocks. By understanding the relative strength and rotation of stocks within the sector, investors can identify opportunities that align with their investment goals and risk appetite. With the technology sector poised for continued growth and innovation, non-mega-cap stocks present an attractive avenue for diversification and capital appreciation in today’s dynamic market environment.