In recent months, as the stock market continues to reach new highs, investors are closely watching market breadth as a potential signal of a market top. Market breadth refers to the number of stocks participating in a market advance or decline. It is often used as a gauge of the overall health of the market, as a strong breadth suggests widespread participation in the market rally, while weak breadth may indicate that only a few stocks are driving the gains.

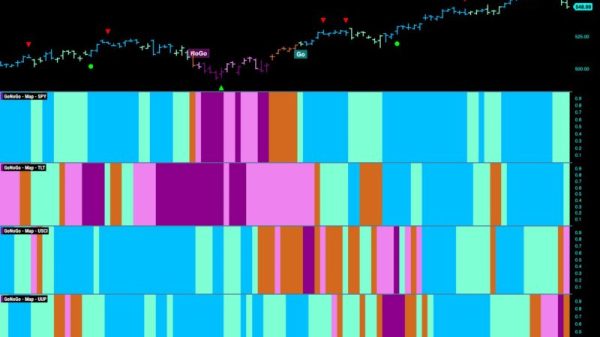

One commonly used measure of market breadth is the Advance-Decline Line (AD Line). The AD Line tracks the difference between the number of advancing and declining stocks on a given day. When the AD Line is rising along with the market, it suggests that a large number of stocks are participating in the rally, which is typically seen as a positive sign for the market. Conversely, a diverging AD Line, where the market is rising but the AD Line is falling, could be a warning sign that the rally is losing momentum.

Another important measure of market breadth is the percentage of stocks above their 200-day moving average. This indicator shows the percentage of stocks in an index that are trading above their long-term trendline. A high percentage suggests that a large number of stocks are in long-term uptrends, which is generally a positive sign for the market. On the other hand, a declining percentage of stocks above their 200-day moving average could indicate weakening market breadth and possibly signal a market top.

Investors also monitor the number of stocks making new highs or new lows as a gauge of market breadth. When a large number of stocks are making new highs, it indicates broad participation in the market rally. Conversely, if the number of new highs starts to decline while the market continues to rise, it could suggest that only a few stocks are driving the gains, which may not be sustainable in the long run.

While market breadth indicators can provide valuable insights into the health of the market, it is important for investors to use them in conjunction with other technical and fundamental analysis tools. No single indicator can predict market movements with certainty, so it is crucial to consider a variety of factors when making investment decisions.

In conclusion, monitoring market breadth indicators such as the Advance-Decline Line, percentage of stocks above their 200-day moving average, and number of stocks making new highs can help investors gauge the strength of a market rally. By paying attention to these measures, investors can better assess the overall health of the market and make informed decisions about their investment portfolios.