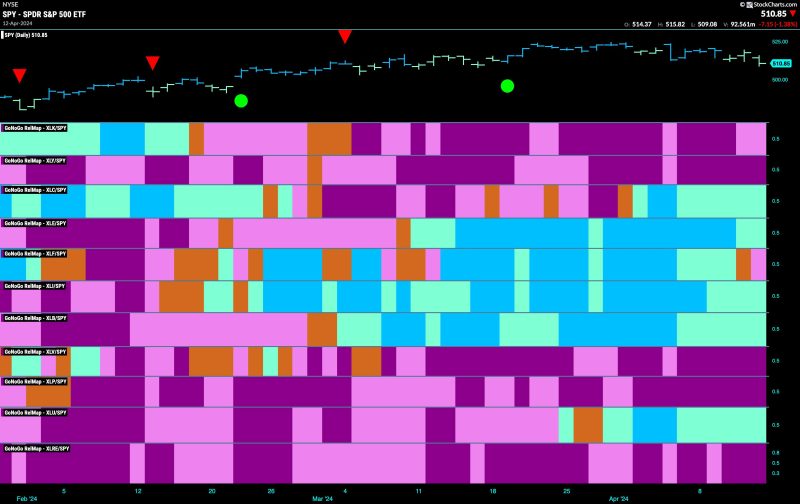

The article linked above discusses the current state of equity markets and how they are struggling to maintain a positive trend, with industrial sectors attempting to lead the charge on April 15, 2024. This article aims to provide a well-structured and unique perspective on the topic.

Understanding Market Trends:

To comprehend the challenges faced by equity markets, it is paramount to analyze the prevailing trends. Market trends are essentially the general direction in which prices are moving. By observing trends, investors can anticipate possible future movements and make informed decisions. Trends can be classified into three categories: uptrend, downtrend, and sideways trend. An uptrend refers to a consistent increase in prices over time, while a downtrend indicates a consistent decrease. A sideways trend, on the other hand, implies a lack of clear direction in price movements.

Impact of Industrial Sector:

The industrial sector plays a significant role in the overall performance of equity markets. It encompasses companies involved in the production of goods, manufacturing, engineering, and construction. As the backbone of the economy, the industrial sector’s performance is closely monitored for insights into broader market trends. When industrial stocks show strength and lead the market, it can be an indication of a healthy economy and positive investor sentiment. Conversely, a decline in industrial stocks may raise concerns about economic slowdown or market instability.

Challenges Faced by Equity Markets:

Equity markets are dynamic and subject to various challenges that can impede their growth. One notable challenge is market volatility, characterized by rapid and unpredictable price movements. Volatility can be triggered by external events such as geopolitical tensions, economic data releases, or natural disasters. Additionally, investor sentiment plays a crucial role in shaping market trends. Fear, optimism, and uncertainty can significantly influence buying and selling decisions, leading to fluctuations in stock prices.

Strategies for Navigating Market Uncertainty:

In the face of market uncertainty, investors can adopt various strategies to navigate turbulent times successfully. Diversification, for instance, involves spreading investments across different asset classes to reduce risk exposure. By diversifying their portfolios, investors can mitigate potential losses resulting from the underperformance of specific sectors. Another strategy is to conduct thorough research and stay informed about market trends. By keeping abreast of the latest developments, investors can make well-informed decisions and adjust their investment approach accordingly.

Looking Ahead:

As equity markets continue to grapple with maintaining a positive trend, it is essential for investors to remain vigilant and adaptable. By understanding market trends, acknowledging the significance of the industrial sector, and implementing effective strategies, investors can navigate the challenges posed by market volatility. Ultimately, staying informed, prudent, and flexible is key to achieving long-term success in the ever-evolving world of equity markets.

In conclusion, the article sheds light on the complexities of equity markets, emphasizing the role of industrial sectors in driving market trends and the challenges faced by investors. By employing prudent strategies and staying informed, investors can proactively navigate market uncertainty and capitalize on opportunities for growth.