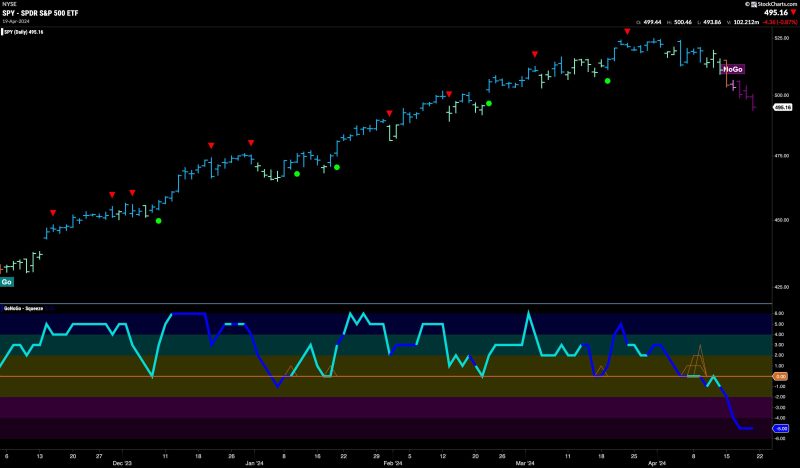

Equities Struggle in Strong NOGO as Materials Try to Curb the Damage

Equities worldwide faced a challenging day as they struggled amidst the prevailing strong NOGO sentiment in the market. The NOGO phenomenon, characterized by investor reluctance, uncertainty, and risk aversion, has created a turbulent trading environment for various assets, including equities. Despite this overarching negative sentiment, materials sector stocks have stood out as they attempt to minimize the damage caused by the widespread market pessimism.

One of the prime factors contributing to the upheaval in the equity markets is the ongoing global economic uncertainty. With various geopolitical tensions, trade disputes, and the lingering impact of the pandemic, investors remain apprehensive about the future outlook. Such uncertainty often leads to risk-off sentiment among investors, prompting them to reduce exposure to riskier assets like equities.

Furthermore, the recent surge in commodity prices has added to the challenges faced by equities. Rising inflation concerns, coupled with supply chain disruptions, have significantly impacted the materials sector, which relies heavily on commodities such as metals and minerals. The soaring costs of raw materials have put pressure on profit margins for companies within the materials sector, leading to a decline in their stock prices.

Amidst the broader market turmoil, companies in the materials sector have been implementing strategic measures to mitigate the impact of the challenging environment. Many firms have focused on optimizing their supply chains, renegotiating contracts with suppliers, and exploring alternative sourcing options to manage costs effectively. Additionally, some companies have ramped up their research and development efforts to enhance product innovation and efficiency, thereby improving their competitive position in the market.

Despite the headwinds facing the materials sector, there have been pockets of resilience and opportunities for growth. Certain subsectors within materials, such as specialty chemicals and renewable materials, have shown promising trends due to increasing demand for sustainable products and technologies. Companies that have positioned themselves well within these segments stand to benefit from shifting consumer preferences and regulatory trends favoring sustainability.

In conclusion, while equities grapple with the strong NOGO sentiment prevailing in the market, the materials sector is striving to weather the storm and curb the damage caused by the challenging environment. By implementing strategic initiatives, focusing on innovation, and capitalizing on emerging trends, companies within the materials sector can navigate through the turbulence and unlock new opportunities for growth and value creation in the long term.