In the realm of personal finance, rules-based money management serves as a fundamental tool for individuals seeking to navigate their financial journey with discipline and precise decision-making. Following on from our exploration of the concept in part one, this article delves into the crucial aspect of measuring the market, an essential step in the process of implementing rules-based money management strategies effectively.

Measuring the market involves analyzing various indicators and metrics to gain insight into the current state of the financial markets. By understanding the market environment, investors and traders can make informed decisions that align with their financial goals and risk tolerance. One key metric used in measuring the market is market breadth, which assesses the participation of individual stocks in a market advance or decline. A broad market advance with a large number of stocks moving higher indicates a healthy and robust market, while a narrow advance may suggest a lack of broad-based strength.

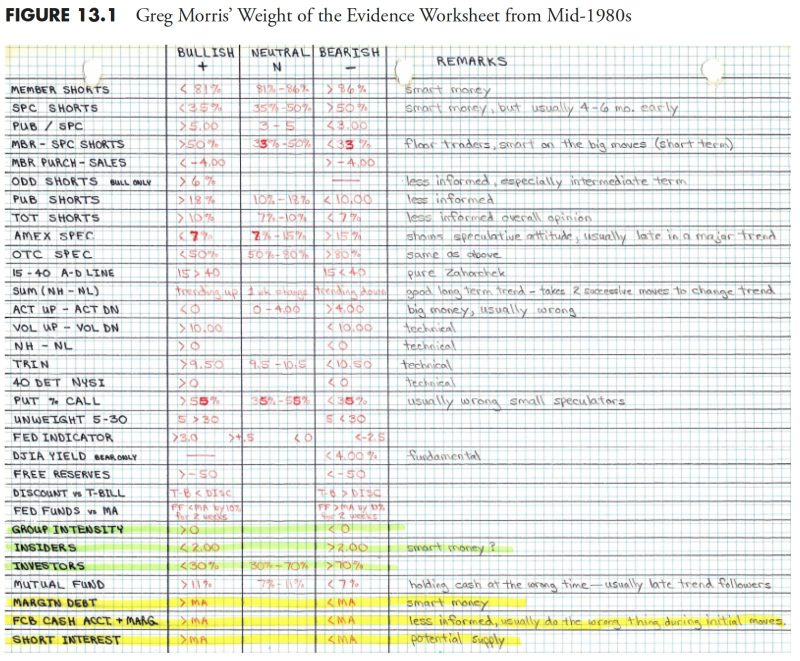

Another vital aspect of measuring the market is assessing market sentiment, which reflects the overall mood or attitude of investors towards the market. Sentiment indicators, such as the put/call ratio and the VIX, can provide valuable insights into market psychology and potential market turning points. Contrarian investors often use sentiment indicators to gauge market extremes and identify opportunities to go against the prevailing sentiment for potential contrarian trades.

Moreover, technical analysis plays a significant role in measuring the market by analyzing price charts and identifying trends, support and resistance levels, and patterns that provide valuable information about market dynamics. Technical indicators like moving averages, relative strength index (RSI), and MACD can help traders and investors gauge market momentum and potential trend reversals.

In addition to market breadth, sentiment analysis, and technical indicators, fundamental analysis also contributes to measuring the market by examining economic data, corporate earnings, and other factors that influence market movements. Understanding the underlying fundamentals of the market can provide a comprehensive view of the investment landscape and help investors make informed decisions based on solid economic reasoning.

In conclusion, measuring the market is a critical component of rules-based money management, as it allows investors and traders to assess the current market environment and adjust their strategies accordingly. By incorporating market breadth analysis, sentiment indicators, technical analysis, and fundamental research into their decision-making process, individuals can enhance their ability to navigate the complexities of the financial markets and pursue their financial goals with greater confidence and precision.