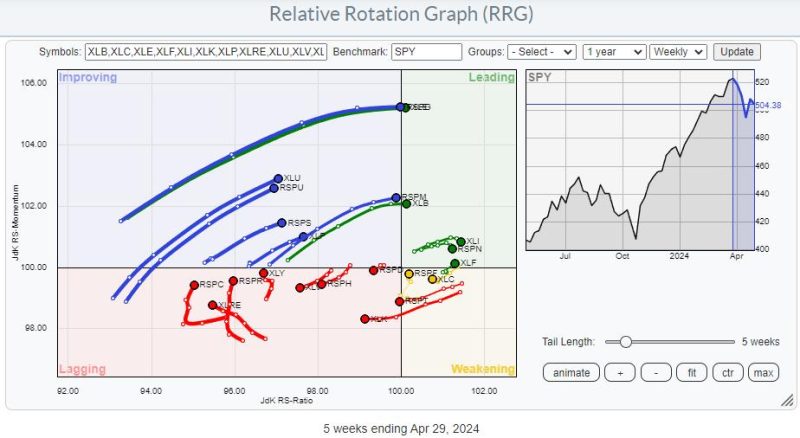

In the referenced article, the Relative Rotation Graph (RRG) is used to analyze the movement of various assets and identify potential trading opportunities. This tool provides a visual representation of the relative strength and momentum of different securities in comparison to a benchmark. By examining the rotational patterns on the graph, traders can pinpoint assets that are likely to outperform or underperform in the near future.

The RRG displayed in the article showcases several assets with diverging tails, each representing a different asset class or sector. The position of an asset on the graph indicates its relative performance compared to the benchmark. Assets in the leading quadrant are displaying strong momentum and are likely to continue outperforming the benchmark. Conversely, assets in the lagging quadrant are underperforming and may present shorting opportunities.

One notable aspect of the RRG is the ability to differentiate between stocks that are moving in sync with the market and those that are deviating from the norm. Assets with diverging tails indicate a unique movement pattern that may present trading opportunities. By focusing on these divergences, traders can identify potential outliers that could generate significant returns.

For instance, the article highlights an asset that is moving towards the weakening quadrant while the benchmark is heading in the opposite direction. This divergence suggests that the asset is losing momentum relative to the market, making it a potential candidate for a short position. Conversely, assets moving towards the leading quadrant while the benchmark is lagging may present buying opportunities as they demonstrate strong relative strength.

In conclusion, the Relative Rotation Graph is a valuable tool for traders looking to identify trading opportunities based on the relative strength and momentum of different assets. By analyzing the diverging tails on the graph, traders can pinpoint assets that are deviating from the market trend and may offer unique trading prospects. The RRG provides a visual representation of relative performance, allowing traders to make informed decisions and capitalize on potential market anomalies.