In the world of investing and trading, the use of technical analysis tools has become increasingly popular. One such tool that is widely used by traders to identify potential buying opportunities is the silver cross buy signal. This signal occurs when a short-term moving average crosses above a longer-term moving average, indicating a potential bullish trend reversal.

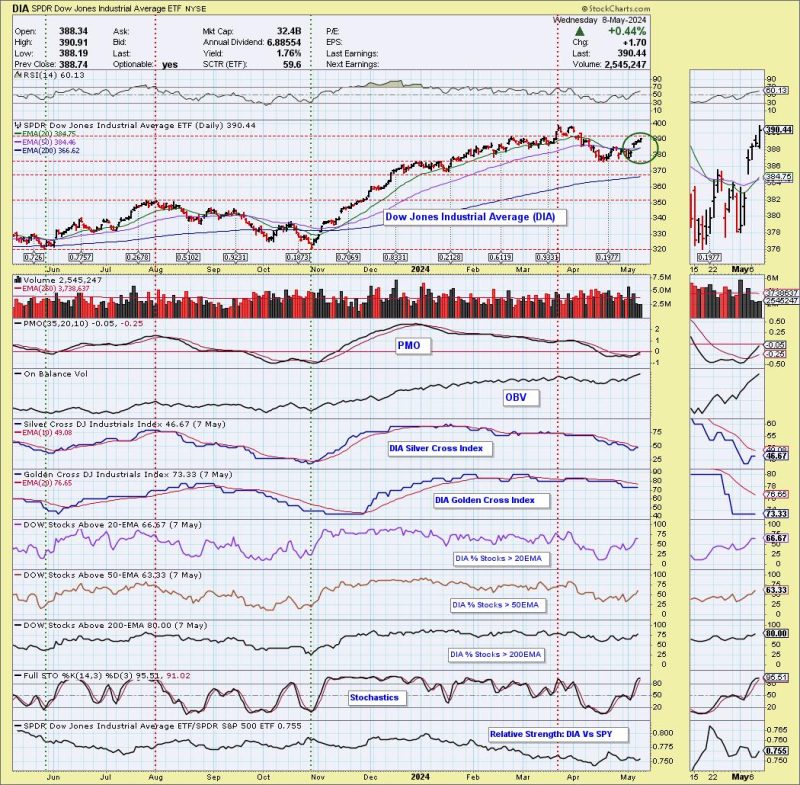

Recently, the silver cross buy signals have been triggered on major market indices such as the Dow Jones Industrial Average (DIA) and the Russell 2000 (IWM). Let’s delve into the significance of these signals and what they may mean for investors moving forward.

The Dow Jones Industrial Average (DIA) is a widely followed index composed of 30 large-cap companies representing various sectors of the economy. The recent silver cross buy signal on the DIA suggests that the average price of these 30 stocks over a shorter period has crossed above the average price over a longer period. This is often interpreted as a bullish signal by traders, indicating a potential upward momentum in the index.

Similarly, the Russell 2000 (IWM) index tracks the performance of small-cap stocks in the United States. The silver cross buy signal on the IWM indicates a similar bullish sentiment, with the short-term moving average surpassing the long-term moving average. This suggests that small-cap stocks may be poised for a potential uptrend in the near future.

While the silver cross buy signals on these indices may signal a potential bullish trend reversal, it is important for investors to exercise caution and consider other factors that may impact market movements. Market volatility, economic indicators, geopolitical events, and company-specific news can all influence asset prices and market trends.

It is also worth noting that no single technical indicator is foolproof, and it is advisable for investors to use a combination of tools and analysis to make informed decisions. Setting stop-loss orders and diversifying portfolios are also essential risk management strategies to consider when trading or investing in the stock market.

In conclusion, the recent silver cross buy signals on the Dow Jones Industrial Average (DIA) and the Russell 2000 (IWM) indices may provide investors with valuable insights into potential bullish trends in the market. However, it is important to combine technical analysis with other forms of research and risk management practices to make well-informed investment decisions. By staying informed and vigilant, investors can navigate market fluctuations and position themselves for long-term success in the ever-changing world of finance.