As the economic landscape continues to shift and evolve, it is crucial for investors to navigate through the complexities of the market in order to make informed decisions. The recent trends in the market suggest that caution is warranted as the market appears to be showing signs of topping out.

One of the key indicators signaling a potential market top is the increasing volatility in various asset classes. Volatility, often seen as a measure of uncertainty and risk, has been on the rise across global markets. This heightened volatility can be attributed to a multitude of factors including geopolitical tensions, trade disputes, and economic uncertainties. Investors should remain vigilant and be prepared for sudden market swings that may impact their portfolios.

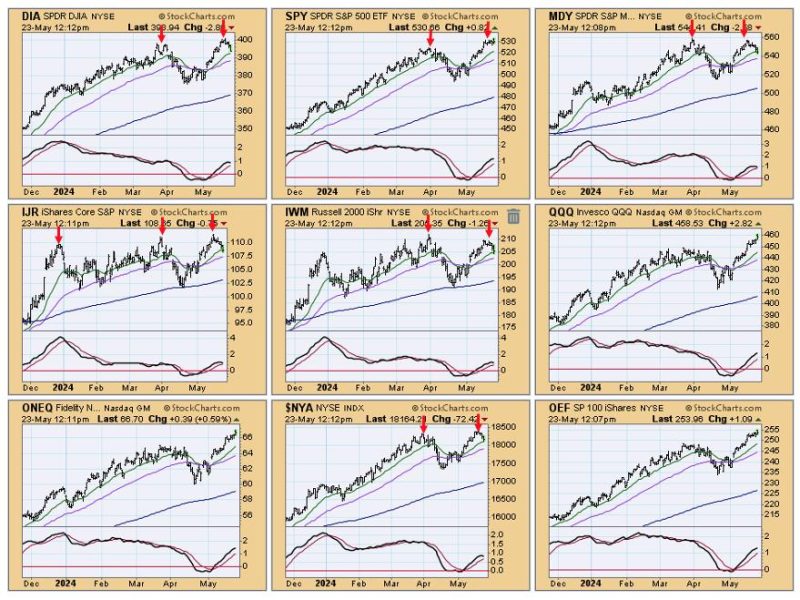

Another concerning factor is the narrowing breadth of the market rally. While major indices may still be hitting record highs, the underlying strength may not be as robust as it seems. A closer look at individual sectors and stocks reveals a lack of broad-based participation in the rally, with fewer companies driving the gains. This lack of market breadth can be a warning sign that the rally is losing steam and may be unsustainable in the long run.

In addition, valuations in certain sectors and asset classes are starting to look stretched. Investors are paying a premium for earnings and growth potential, raising concerns about a potential market correction. It is important for investors to carefully assess the valuation metrics of their investments and ensure that they are not overpaying for future returns.

Furthermore, inflationary pressures and rising interest rates pose additional challenges to the market outlook. As central banks move towards tightening monetary policy, borrowing costs are on the rise and could weigh on consumer spending and investment decisions. Investors should closely monitor the Federal Reserve’s actions and statements for clues on future interest rate hikes and their impact on the market.

In conclusion, while the market may still be riding high, there are several warning signs that suggest caution is warranted. Heightened volatility, narrowing market breadth, stretched valuations, and rising interest rates all point to a potential market top. Investors should remain vigilant, conduct thorough research, and consider diversifying their portfolios to mitigate risks in the face of an uncertain market environment.