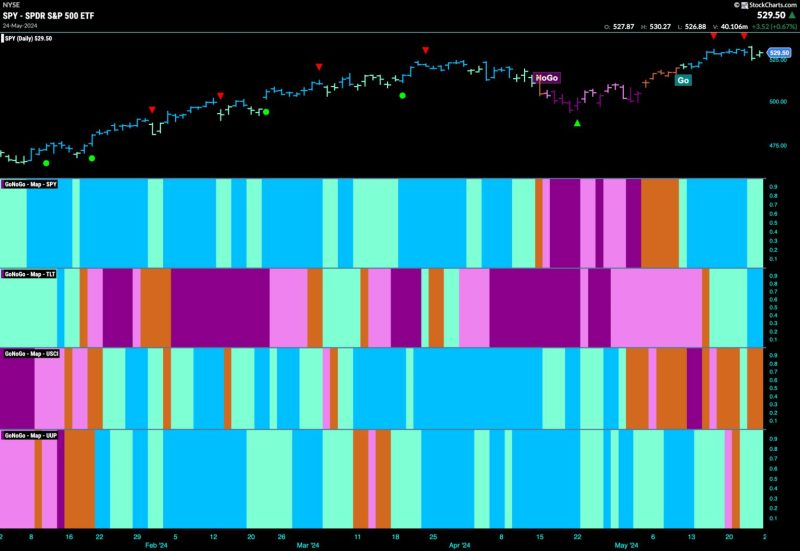

Equities Remain in Growth Trend with Sparse Leadership from Tech and Utilities

The equity market continues to see a growth trend with sporadic leadership from the technology and utilities sectors. Investors are closely monitoring the performance of these sectors as they navigate through the current market landscape. While tech stocks have been the frontrunners in recent years, other sectors are now showing signs of strength and providing leadership in the market. Utilities, traditionally considered defensive plays, are also emerging as key players in the current market environment.

The technology sector, which has been a major driver of market returns in recent years, has seen some fluctuations in performance. While tech stocks continue to be favored by investors for their growth potential, concerns over valuation and regulatory risks have led to some volatility in the sector. As a result, investors are diversifying their portfolios and looking for opportunities in other sectors that offer stability and potential growth.

One such sector is utilities, which have traditionally been viewed as defensive plays due to their stable cash flows and reliable dividends. However, utilities are now attracting attention from investors as companies in this sector are investing in renewable energy and infrastructure projects, which are seen as key drivers of future growth. Utilities are also benefiting from low-interest rates, which reduce their borrowing costs and improve their profitability.

The healthcare sector is another area that is showing resilience in the current market environment. Healthcare companies, particularly those involved in biotechnology and pharmaceuticals, are benefiting from innovation and strong demand for healthcare products and services. The ongoing COVID-19 pandemic has also highlighted the importance of healthcare companies in providing solutions to global health challenges.

Moreover, the consumer discretionary sector is also performing well, driven by strong consumer spending and confidence. Companies in this sector, such as retail and leisure companies, are benefiting from pent-up demand as economies reopen and consumers increase their spending on discretionary items.

While some sectors are leading the market higher, others are facing challenges. The energy sector, for example, continues to struggle due to low oil prices and sluggish demand. Companies in this sector are under pressure to adapt to changing market conditions and transition to cleaner energy sources.

In conclusion, equities remain in a growth trend with sporadic leadership from sectors such as technology, utilities, healthcare, and consumer discretionary. Investors are advised to diversify their portfolios and consider opportunities beyond traditional tech stocks to capitalize on the evolving market dynamics. By staying informed and proactive, investors can navigate the market landscape and identify potential opportunities for growth and profitability.