In recent news, the Securities and Exchange Commission (SEC) has made significant charges against renowned investor Carl Icahn, alleging that he concealed billions of dollars’ worth of stock pledges, raising questions about transparency and compliance in the financial world.

The SEC’s investigation revealed that Icahn failed to disclose important information regarding his stock holdings and transactions, including his pledge of over $8 billion worth of shares as collateral for margin loans. This lack of disclosure could potentially mislead investors, creating a distorted image of Icahn’s actual financial position and investment strategies.

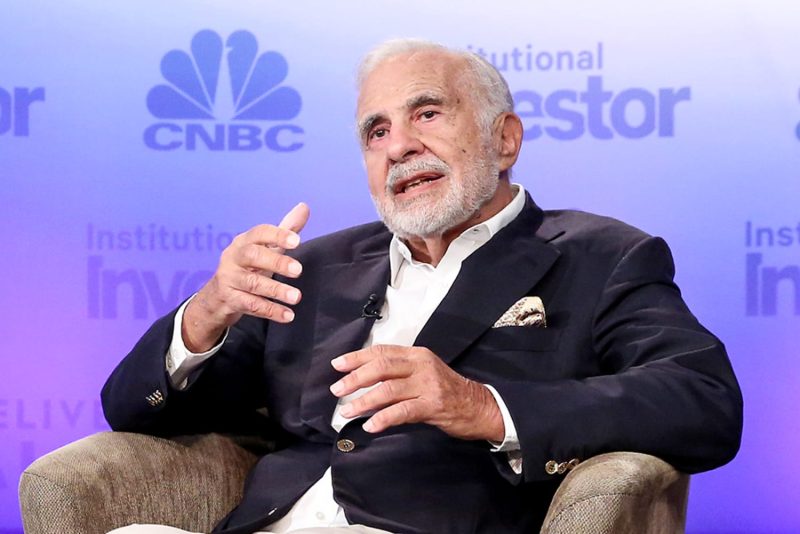

Icahn, known for his activist approach to investing and significant influence in corporate decision-making, has found himself at the center of controversy due to these alleged violations. The SEC’s charges highlight the importance of stringent regulatory oversight and the need for investors to be diligent in examining the transparency and integrity of financial transactions.

Transparency and disclosure are fundamental pillars of the financial markets, fostering trust and confidence among investors. When prominent figures like Carl Icahn are accused of concealing significant stock pledges, it can undermine the credibility of the entire financial system and erode investor trust.

The ramifications of these charges against Icahn could extend beyond his personal reputation, impacting the broader investment community and regulatory landscape. The SEC’s enforcement actions serve as a reminder that compliance with securities laws and regulations is non-negotiable, regardless of one’s stature in the financial world.

Moving forward, it will be crucial for investors, regulators, and market participants to remain vigilant and uphold the principles of transparency and accountability. By enforcing stringent disclosure requirements and holding individuals accountable for their actions, we can help safeguard the integrity and stability of the financial markets for the benefit of all stakeholders.

As the case against Carl Icahn unfolds, it serves as a powerful reminder of the importance of ethical conduct, regulatory compliance, and transparency in the world of finance. Ultimately, maintaining trust and confidence in the financial system requires a commitment to upholding the highest standards of integrity and accountability, ensuring a level playing field for all investors.