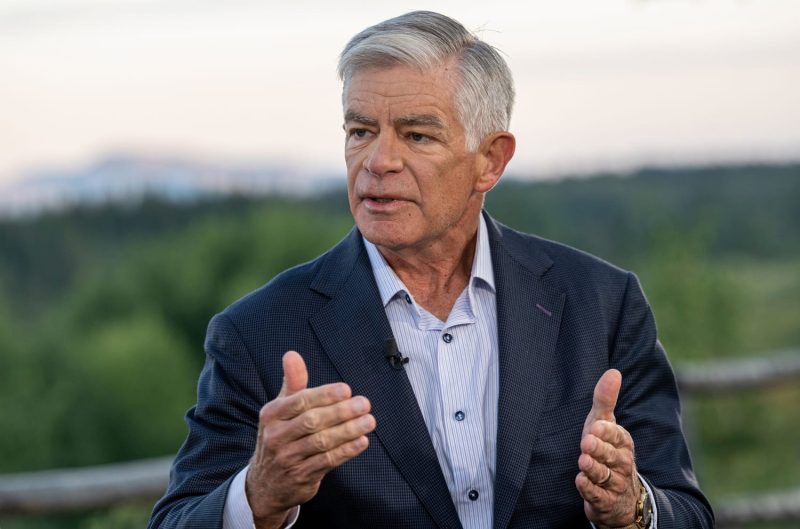

Philadelphia Fed President Patrick Harker Advocates for Interest Rate Cut in September

In a recent speech, Philadelphia Fed President Patrick Harker argued in favor of an interest rate cut in September. This comes as a notable shift in his stance, as he was previously one of the Federal Reserve officials who favored keeping rates steady earlier this year. Harker’s support for a rate cut reflects growing concerns over the impact of trade tensions and slowing global growth on the U.S. economy.

Harker emphasized the need for proactive measures to safeguard the economy against potential headwinds. He highlighted the uncertainty surrounding trade policy and its potential to disrupt business investment and consumer confidence. By lowering interest rates, Harker believes the Fed can provide a necessary boost to economic activity and mitigate risks of a downturn.

The Federal Reserve has been under pressure to address mounting economic challenges, including subdued inflation and weakening manufacturing activity. Harker’s advocacy for an interest rate cut signals a shift towards a more accommodative monetary policy stance aimed at supporting growth.

However, the decision to cut rates is not without its critics. Some argue that lowering interest rates could fuel asset bubbles and distort market signals. Additionally, there are concerns about the Fed’s limited room for further rate cuts if the economy experiences a more severe downturn.

Harker’s call for an interest rate cut reflects the delicate balancing act the Fed faces in managing economic risks. As policymakers weigh their options, they must carefully consider the potential benefits and drawbacks of lowering rates in the current economic environment.

In conclusion, Philadelphia Fed President Patrick Harker’s advocacy for an interest rate cut in September underscores the challenges facing the U.S. economy. By signaling a shift towards a more accommodative monetary policy stance, Harker aims to provide support for economic growth amid mounting uncertainties. As the Federal Reserve evaluates its policy options, the decision to cut rates will require careful consideration of its potential impacts on the economy and financial markets.