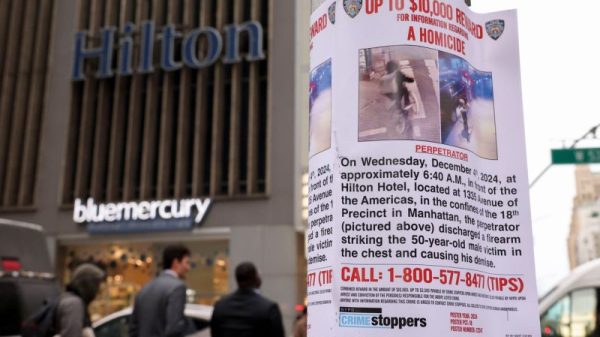

Chase Bank’s Referral of Check Fraud Glitch Incidents to Authorities Raises Concerns

The recent decision by Chase Bank to refer check fraud glitch incidents to authorities has sparked debate and raised concerns among customers and stakeholders alike. The move comes in response to a series of reported cases where customers have been inadvertently affected by a system glitch that led to unintended fraudulent activities. While Chase Bank’s decision to involve authorities in addressing these incidents may be seen as a proactive measure to protect its customers and maintain integrity in its operations, some have raised questions about the implications of such actions.

One major concern raised by customers and consumer rights advocates is the potential impact on innocent individuals who may have unknowingly been involved in fraudulent transactions due to the glitch. By referring these cases to authorities, there is a possibility that individuals who have no malicious intent could face legal repercussions for actions they did not intentionally commit. This situation raises important ethical considerations about the responsibility of financial institutions to protect customers while ensuring fair treatment for all parties involved.

Additionally, the decision by Chase Bank to involve law enforcement agencies in addressing check fraud glitches could have broader implications on customer trust and confidence in the banking system. Customers may feel hesitant to use banking services or conduct financial transactions out of fear of being wrongly implicated in fraudulent activities. This could potentially lead to a loss of trust in banking institutions and impact customers’ willingness to engage in traditional banking practices.

Furthermore, the transparency and communication surrounding Chase Bank’s handling of these fraud incidents have also come under scrutiny. Customers have expressed concerns about the lack of clear information provided by the bank regarding the nature of the glitches, the steps being taken to rectify the situation, and the potential risks and consequences faced by those inadvertently involved. Clear and timely communication is essential to maintaining trust and credibility with customers, and any perceived lack of transparency can further diminish confidence in the bank’s ability to handle such situations effectively.

In conclusion, while Chase Bank’s decision to refer check fraud glitch incidents to authorities may be well-intentioned in its efforts to address fraudulent activities and protect customers, there are valid concerns about the impact on innocent individuals, customer trust, and communication transparency. It is essential for financial institutions to strike a balance between safeguarding their operations and ensuring fair treatment for all parties involved. Moving forward, open dialogue, clear communication, and proactive measures to prevent similar incidents are crucial in navigating the complex landscape of financial fraud and maintaining customer trust.