In the world of investing, the impact of interest rate cuts on the stock market is a subject of much debate and speculation. Investors often wonder whether rate cuts will trigger a bullish or bearish trend in the stock market. This article aims to uncover the truth behind the relationship between rate cuts and stock performance.

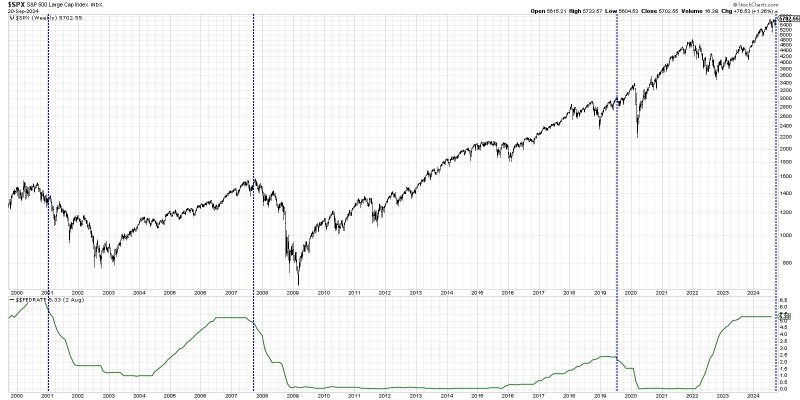

Historically, central banks use interest rate cuts as a tool to stimulate economic growth during times of recession or economic slowdown. By lowering interest rates, central banks aim to make borrowing cheaper for businesses and individuals, thereby encouraging spending and investment. In theory, this can lead to increased corporate profits and higher stock prices.

However, the effect of rate cuts on stock performance is not always straightforward. Several factors come into play that can influence the market’s reaction to rate cuts. Firstly, the market often anticipates rate cuts and may already have factored them into stock prices before the cuts are officially announced. In such cases, the actual rate cut may not have a significant impact on stock performance.

Additionally, the context in which rate cuts occur can also affect their impact on the stock market. For example, if a rate cut is perceived as a proactive measure to prevent an upcoming recession, it may be viewed positively by investors and lead to a bullish market. On the other hand, if rate cuts are seen as a reactive response to a deteriorating economy, they may signal underlying weakness and result in a bearish market sentiment.

Furthermore, the effectiveness of rate cuts in boosting stock prices can vary depending on other economic indicators and geopolitical factors. For instance, if corporate earnings are declining or trade tensions are escalating, rate cuts may not be sufficient to offset these negative forces and support stock prices.

It is essential for investors to consider a holistic view of the market and not rely solely on rate cuts as a predictor of stock performance. Other factors, such as company fundamentals, industry trends, and global economic conditions, should also be taken into account when making investment decisions.

In conclusion, while interest rate cuts can have an impact on stock performance, their effects are nuanced and influenced by a variety of factors. Investors should approach rate cuts as one piece of the broader economic puzzle and consider the larger market context when assessing their potential implications for stock prices. By staying informed and maintaining a diversified portfolio, investors can navigate the complexities of rate cuts and make sound investment choices in any market environment.