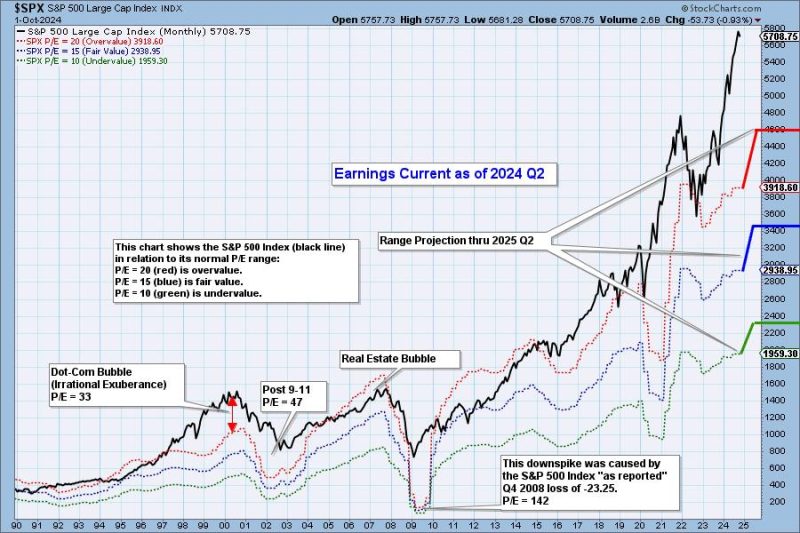

As 2024 Q2 Earnings Roll In, the Market Remains Very Overvalued

The financial markets have been buzzing with excitement as companies release their earnings reports for the second quarter of 2024. Investors have been eagerly awaiting these figures to gauge the health and performance of various industries and the overall economy. However, as the earnings season progresses, one thing becomes increasingly clear – the market remains very overvalued.

Many analysts and experts have been pointing out the disparity between stock prices and underlying fundamentals for some time now. As companies continue to report strong earnings, the stock market continues to hit new highs, with valuation metrics reaching levels not seen in decades. This has raised concerns among some investors who fear that a correction may be on the horizon.

One of the main reasons for the market’s overvaluation is the abundance of liquidity in the system. The Federal Reserve and other central banks around the world have flooded the markets with cheap money in an effort to stimulate economic growth and combat the effects of the pandemic. While this has helped support asset prices and fuel a stock market rally, it has also led to inflated valuations and a disconnect between stock prices and economic reality.

Another factor contributing to the market’s overvaluation is the dominance of large tech companies. Companies like Apple, Amazon, and Google have seen their stock prices soar in recent years, driving up the overall valuation of the market. While these companies have been able to deliver strong earnings growth, concerns about regulatory scrutiny and antitrust issues have led some investors to question whether their valuations are warranted.

In addition to the macroeconomic factors at play, there are also company-specific issues that are contributing to the market’s overvaluation. Many companies have been engaging in share buybacks and other financial engineering tactics to boost their stock prices and appease shareholders. While these strategies can lead to short-term gains, they may not be sustainable in the long run and could result in a future reckoning.

As investors navigate the current environment, it is important to approach the market with caution and conduct thorough due diligence before making investment decisions. While it is impossible to predict when or how a market correction may occur, being mindful of the market’s overvaluation and taking steps to protect your portfolio can help mitigate potential risks.

In conclusion, as the 2024 Q2 earnings season unfolds, it is becoming increasingly evident that the market remains very overvalued. Investors should be aware of the factors contributing to this overvaluation and take appropriate steps to protect their investments. By staying informed and exercising prudence, investors can navigate the current market environment with confidence and resilience.