The article you provided offers valuable insights into the market moves and perspectives on the Nifty index. Delving deeper into understanding the dynamics of the market and applying certain perspectives can enable investors to make more informed decisions. Here, we will explore a few key points highlighted in the article and further elaborate on them.

1. Technical Analysis and Long-Term View:

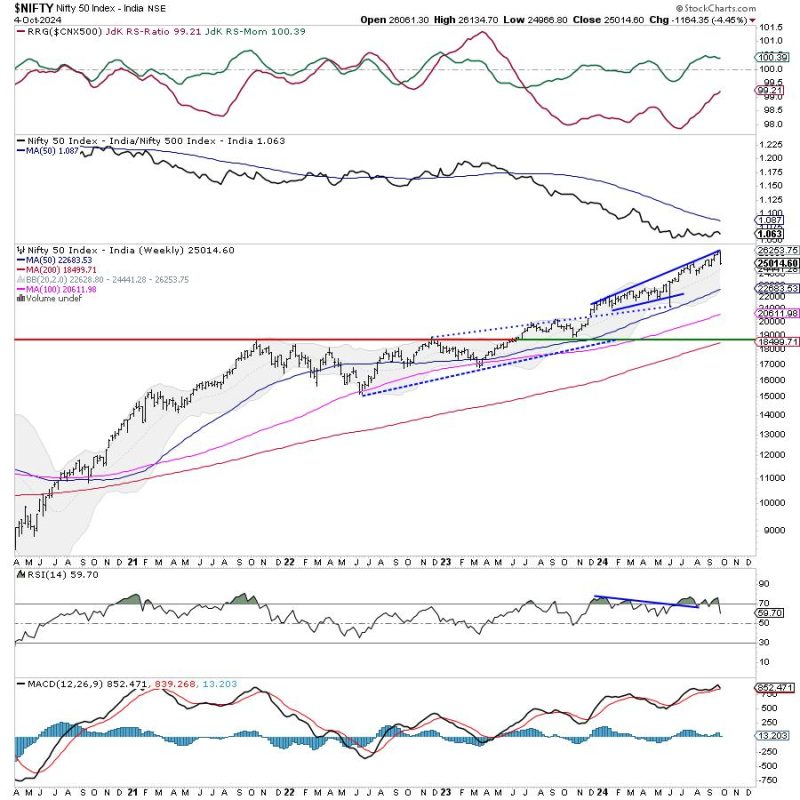

The article emphasizes the importance of technical analysis in understanding market trends and making decisions accordingly. By using tools like charts, moving averages, and support/resistance levels, investors can gauge the market sentiment and potential price movements. Additionally, having a long-term view is crucial in navigating through short-term fluctuations and focusing on the broader outlook of the market.

2. Behavioral Finance and Emotional Control:

Behavioral finance plays a significant role in influencing market moves and individual decision-making processes. Understanding behavioral biases such as herd mentality, overconfidence, or fear can help investors avoid impulsive actions and make rational choices. Embracing emotional control and discipline in trading can lead to better risk management and more consistent outcomes in the long run.

3. Fundamental Analysis and Market Intelligence:

Combining technical analysis with fundamental insights can provide a comprehensive understanding of the market dynamics. Examining factors like economic indicators, company performance, and industry trends can help investors identify potential opportunities and risks. Furthermore, staying updated on market news and developments can offer valuable intelligence for making informed decisions.

4. Risk Management and Portfolio Diversification:

Risk management is a crucial aspect of successful investing, as it helps mitigate potential losses and preserve capital. Implementing strategies like stop-loss orders, position sizing, and diversification can safeguard investments against unexpected market moves. Maintaining a balanced portfolio across different asset classes and sectors can also reduce overall risk exposure and enhance long-term returns.

5. Market Volatility and Adaptability:

Market volatility is an inherent aspect of trading and investing, presenting both challenges and opportunities for market participants. Being adaptable to changing market conditions and adjusting strategies accordingly is essential for navigating through uncertain times. By embracing flexibility and continuously learning from market experiences, investors can stay ahead of the curve and capitalize on emerging trends.

In conclusion, by adopting a holistic approach that combines technical analysis, behavioral finance insights, fundamental analysis, risk management practices, and adaptability to market dynamics, investors can position themselves for long-term success in the ever-evolving financial markets. By staying informed, disciplined, and focused on their investment objectives, individuals can navigate through market moves with confidence and perspective.