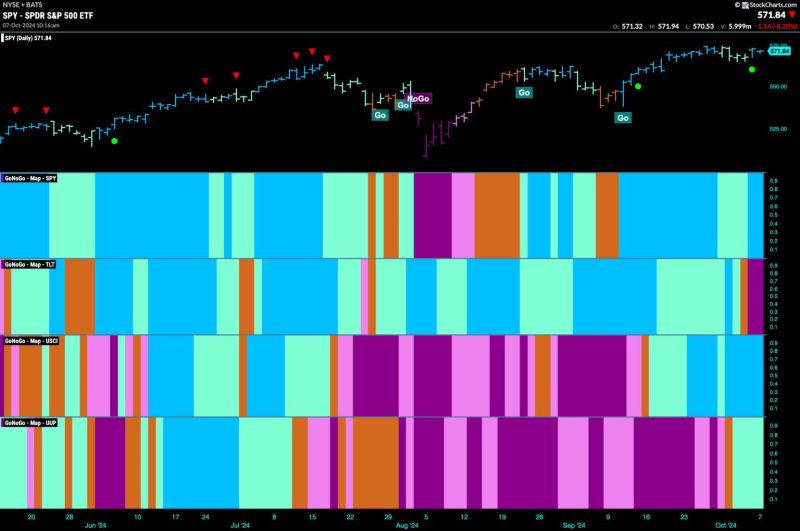

Equities Remain in Go Trend and Lean into Energy

The current market trend for equities remains resolutely positive, prompting investors to capitalize on the momentum and consider energy as a strategic sector for investment. As financial markets continue to show strength and resilience, savvy market participants are leveraging this trend to optimize their portfolios and potentially maximize returns in the energy sector.

The momentum driving equities can be attributed to a variety of factors, including robust economic indicators, positive earnings reports, and the ongoing low interest rate environment. These conditions have created a favorable backdrop for equities, encouraging investors to stay on the go and remain actively engaged in the market.

One sector that has particularly garnered attention in this environment is energy. The energy sector has experienced significant fluctuations over the past year, driven by factors such as shifting global demand dynamics, geopolitical tensions, and advancements in renewable energy technologies. Despite this volatility, energy remains a critical component of the global economy and presents compelling opportunities for investors.

Investors looking to capitalize on the momentum in equities can consider allocating a portion of their portfolio to energy-related assets. This could include investments in traditional energy companies, renewable energy firms, or energy infrastructure projects. By diversifying across various segments of the energy sector, investors can potentially benefit from both short-term market trends and long-term growth prospects.

Furthermore, investing in energy can provide portfolio diversification benefits, as the sector often exhibits low correlation with other asset classes. This can help mitigate risk and enhance the overall stability of a portfolio, particularly in times of heightened market volatility.

As with any investment decision, careful research and due diligence are essential when considering exposure to the energy sector. Investors should evaluate the fundamentals of individual companies, assess market trends and macroeconomic factors, and consider their own risk tolerance and investment objectives.

In conclusion, the current market trend for equities presents a compelling opportunity for investors to lean into the energy sector and potentially enhance their investment returns. By remaining on the go and actively engaging with the market, investors can position themselves to capitalize on positive market momentum and navigate the evolving landscape of the energy sector.