As the global markets continue to navigate uncertainties and volatility, Indian equities have been witnessing a phase of consolidation as the Nifty hovers around crucial levels. Market participants are keeping a close eye on various factors that could potentially impact the direction of the market in the coming days. Let’s delve into some key levels and factors that investors need to monitor in the week ahead.

1. **Support and Resistance Levels:**

The Nifty has been consolidating within a range, with support levels around 15,350 and resistance levels near 15,700. Traders and investors should monitor these levels closely as a breakout above or below could signal a potential trend reversal.

2. **Global Cues:**

With global events such as central bank meetings, economic data releases, and geopolitical tensions impacting the markets, it is essential to stay updated on international developments. Any significant movements in global equities and commodities can have a cascading effect on Indian markets.

3. **Sectoral Rotation:**

Sectoral rotation plays a crucial role in determining the market’s direction. Keep an eye on the relative strength of various sectors such as IT, pharma, financials, and energy. Understanding the sectoral dynamics can help in identifying potential opportunities for investment.

4. **Market Breadth:**

The breadth of the market, indicated by the number of advancing and declining stocks, can provide valuable insights into the overall market sentiment. A healthy market breadth with a good mix of stocks participating in the rally is usually indicative of a robust market.

5. **Volatility Index (VIX):**

The VIX, often referred to as the fear index, is a measure of market volatility and investor sentiment. A rising VIX usually indicates increasing uncertainty and can lead to higher market fluctuations. Monitoring the VIX can help in assessing market risks and adjusting investment strategies accordingly.

6. **Corporate Earnings:**

Earnings season is a crucial period for investors as companies report their financial performance. Keep an eye on corporate earnings announcements, as better-than-expected results can act as a catalyst for stock movements. Analyzing the earnings reports can provide valuable insights into individual stock performance.

7. **Macroeconomic Indicators:**

Economic indicators such as GDP growth, inflation rates, industrial production, and PMI data can provide valuable insights into the overall health of the economy. Stay informed about upcoming economic releases and their potential impact on market sentiment.

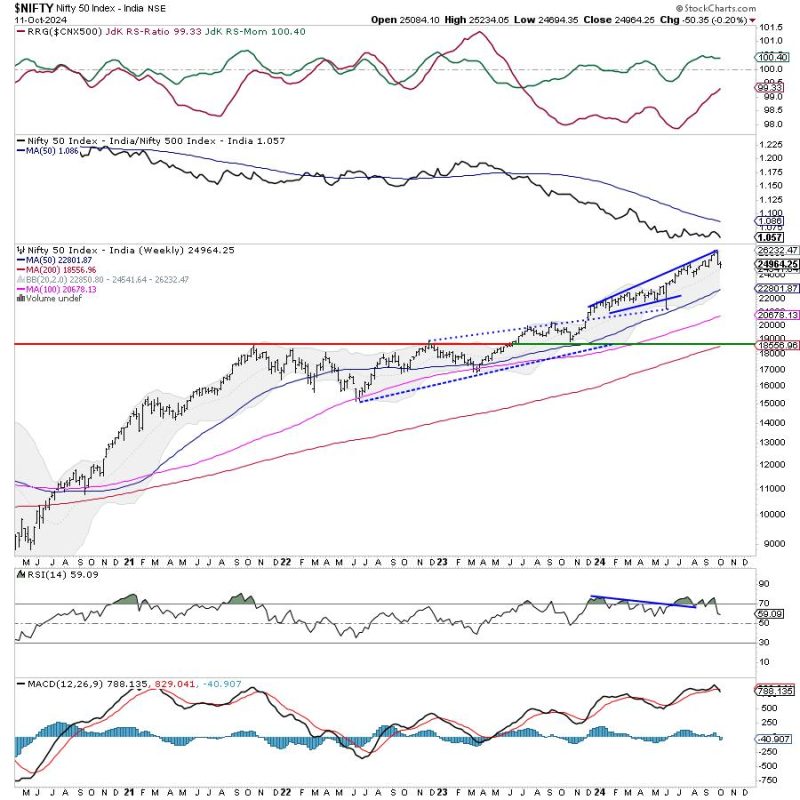

8. **Technical Analysis:**

Technical analysis plays a vital role in understanding market trends and identifying potential entry and exit points. Utilize technical indicators such as moving averages, MACD, RSI, and Fibonacci retracement levels to make informed trading decisions.

In conclusion, navigating the complex dynamics of the stock market requires a keen understanding of various factors that can influence market movements. By staying informed, conducting thorough research, and remaining disciplined in your investment approach, you can effectively navigate market fluctuations and capitalize on emerging opportunities. Keep a watchful eye on the developments discussed above and adapt your strategies accordingly to make informed and prudent investment decisions in the week ahead.