The article you shared highlights the market outlook for the Nifty, suggesting a potential sluggish trend due to various resistance levels. Let’s dive deeper into the factors influencing the Nifty’s performance and what investors can expect in the coming week.

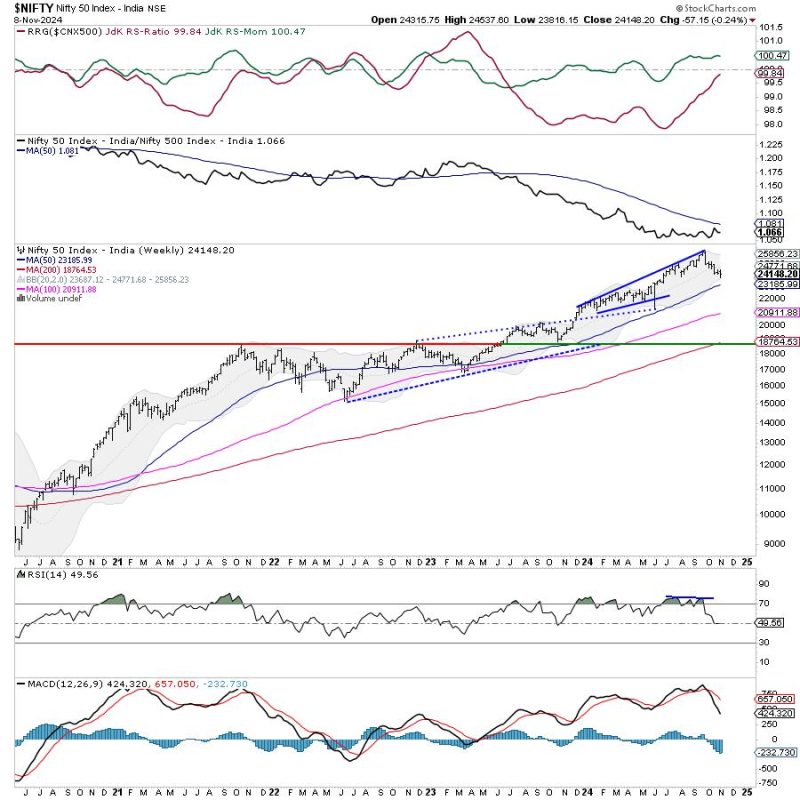

1. **Market Analysis:** The Nifty, being a key benchmark index in India, is closely watched by investors and traders alike. The article suggests that the Nifty is likely to face challenges in the upcoming week, primarily due to multiple resistance levels in its path. This analysis indicates that investors should exercise caution and be prepared for a potentially slow market movement.

2. **Technical Levels:** Technical analysis plays a crucial role in predicting market trends. The presence of multiple resistance levels indicates that there are significant barriers that the Nifty needs to overcome to establish a bullish trend. Traders and investors who follow technical indicators may find this information valuable in setting their trading strategies for the week ahead.

3. **Market Sentiment:** Market sentiment can also influence the Nifty’s performance. In a sluggish market, investors may adopt a cautious approach, leading to lower trading volumes and subdued market activity. It is essential for market participants to stay informed about the prevailing sentiment and adjust their investment decisions accordingly.

4. **Economic Indicators:** Apart from technical factors and market sentiment, economic indicators can also impact the Nifty’s movement. Factors such as inflation rates, GDP growth, and corporate earnings can provide insights into the overall health of the economy, which in turn affects the stock market performance. Investors should closely monitor these indicators to make informed decisions.

5. **Risk Management:** In a market where multiple resistances are anticipated, risk management becomes crucial. Investors should consider diversifying their portfolios, setting stop-loss orders, and having a clear exit strategy in place. By managing risks effectively, investors can protect their capital in volatile market conditions.

6. **Long-term Perspective:** While short-term market predictions can be challenging, it is essential for investors to maintain a long-term perspective. Market fluctuations are a natural part of investing, and staying focused on long-term financial goals can help investors navigate through short-term uncertainties.

In conclusion, the article’s insight into the Nifty’s potential sluggishness due to multiple resistances provides valuable information for investors and traders. By staying informed about market trends, technical levels, and risk management strategies, investors can better position themselves to navigate through uncertain market conditions and make informed investment decisions.