In the world of forex trading, the US dollar (USD) has always been a major player. Traders closely monitor its movements and fluctuations, as the USD’s performance can have a significant impact on the global economy. Recently, there has been speculation about the potential for a USD rally. But what factors are driving this sentiment, and is the USD truly poised for a perfect rally?

One key driver of the USD rally speculation is the US Federal Reserve’s monetary policies. The Fed plays a crucial role in shaping the value of the USD through its decisions on interest rates and quantitative easing measures. In recent times, the Fed has indicated a more hawkish stance on monetary policy, hinting at potential interest rate hikes to combat inflationary pressures. Such a tightening of monetary policy tends to boost the value of the USD, making it more attractive to investors.

Furthermore, the economic fundamentals of the United States also come into play when considering the potential for a USD rally. The US economy has shown resilience in the face of the COVID-19 pandemic, with strong GDP growth, low unemployment rates, and robust consumer spending. This economic strength could further support the USD’s rally, as investors seek out safe-haven assets in uncertain times.

Geopolitical factors also play a significant role in shaping currency movements, including the USD. The ongoing tensions between the US and major trading partners like China, as well as the political instability in various regions, can impact the USD’s value. Uncertainty and geopolitical risks often drive investors towards safe-haven currencies like the USD, potentially fueling a rally.

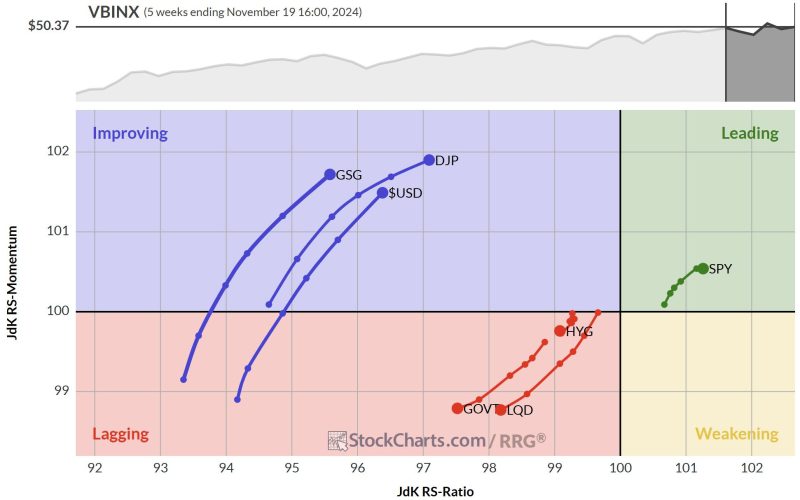

In addition to external factors, technical analysis also offers insights into the potential for a USD rally. Traders often look at key chart patterns, moving averages, and other technical indicators to predict future price movements. If these technical signals align with the fundamental factors supporting a USD rally, it could strengthen the case for a bullish outlook on the currency.

While the prospects for a USD rally seem promising, it’s essential to keep in mind that the currency markets are highly unpredictable. Unexpected events, such as geopolitical tensions, economic data surprises, or shifts in market sentiment, can quickly alter the USD’s trajectory. Traders should exercise caution and stay informed about the latest developments to navigate potential opportunities and risks in the forex market.

In conclusion, the USD’s potential for a perfect rally stems from a combination of factors, including the US Federal Reserve’s monetary policies, economic fundamentals, geopolitical tensions, and technical analysis. While these factors point towards a bullish outlook for the USD, traders should remain vigilant and adaptable to navigate the dynamic nature of the currency markets. As the forex landscape continues to evolve, staying informed and being prepared for all scenarios is key to success in trading the USD.